2026/01/08 | Andrés Pérez M., Vittorio Peretti, Andrea Tellechea & Ignacio Martínez

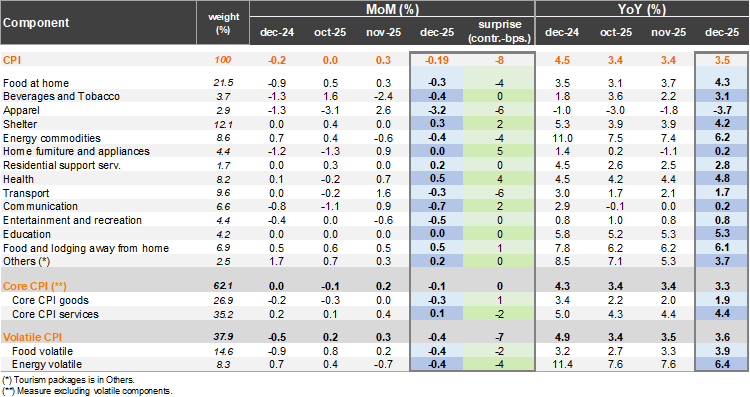

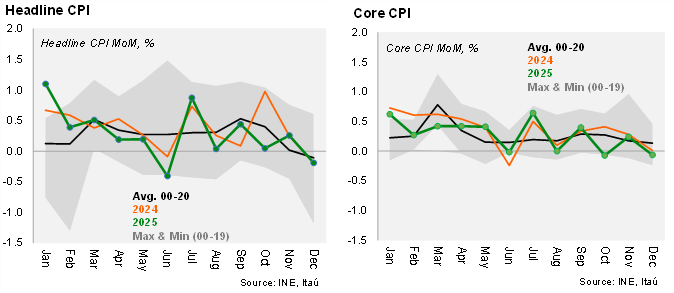

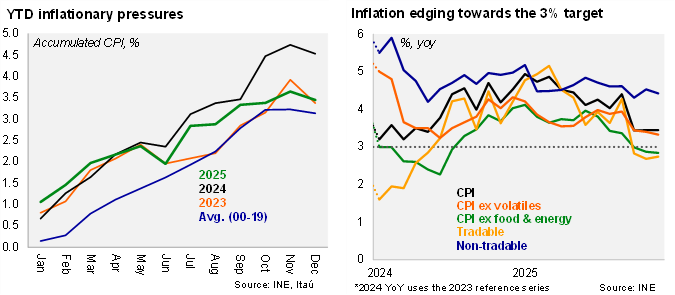

The December downside surprise was mainly explained by volatile items. According to the INE, the consumer price index fell by 0.19% MoM in December, slightly below the Bloomberg median (-0.1%) and our call (-0.12%. Breakevens fell 3bps yesterday to -0.16%. The BCCh’s implicit estimate in the IPoM for December CPI was -0.05%. A key price drag in the month was International Air Travel (-15.9%, partially unwinding the previous month’s surge), along with Telecommunications and certain fruits and vegetables. The bulk of the surprise to our call came from volatile food and energy items. On an annual basis, inflation reached 3.5%, up 0.1pp from November, within the upper half of the 3% inflation target’s tolerance range (+/- 1%). The 3.5% close to 2025 was in line with our call, while a tick below the updated BCCh scenario (3.6%). Core inflation fell by 0.1% MoM, in line with our forecast (-0.06%) but slightly below the BCCh’s implicit IPoM estimate (0.0%). On an annual basis, core fell to 3.3% YoY (BCCh: 3.4%), the lowest since June 2024. Core goods fell at the margin (-0.3% MoM), leading to an annual rise of 1.9%, while core services increased by 0.1% MoM and by 4.4% YoY.

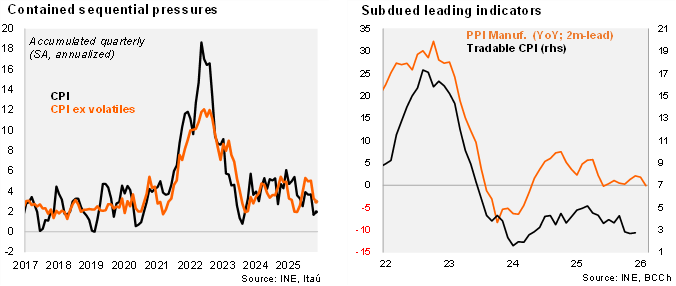

Sequential pressures dropped in 4Q. At the margin, annualized inflation accumulated over the final quarter of last year reached 2.3% (3.7% in 3Q), while core inflation sat at 2.5% (core goods 0.2%, core services 3.5%). Volatile inflation ticked up 0.1pp to 3.6%. Food inflation sits at 4.2% (3.6% in November) and energy inflation reached 6.4% (7.4% in November). Excluding food and energy prices, inflation dropped by 10bps to 2.8%. Meanwhile, nominal wage data for November remained at 5.9%, yet well below the 8.5% in November 2024.

Our take: The December print is the third consecutive downside inflation surprise, relative to the Bloomberg median, and takes place in the context of a swift appreciation of the CLP since the end-July peak (9%). Of note, however, an important share of the surprise in December was driven by volatiles. The moderation of core services is a positive development for Chile’s inflation story, as the labor market maintains slack. The nominal minimum wage increased by 3.7% in May 2025 and then by 1.9% in January 2026, culminating a 54% nominal increase since March 2022. The next minimum wage legislative discussion takes place annually in May; our scenario considers a slightly positive real increase in 2026. The swift appreciation of the CLP in recent weeks has been accompanied by a decline in breakevens throughout 2026, also reflected by a decline in the BCCh’s trader survey one-year ahead median to 2.9% (below the 3% target for the first time since early 2024). Survey-based inflation expectations at the two-year horizon are anchored at the 3% target, a solid sign of the target’s credibility. INE is scheduled to release January’s inflation on February 6; prior to today’s print, breakevens were at 0.4% MoM. While electricity prices are projected to decline in January, the INE should not consider the fall in its measurement. Our scenario considers inflation averaging 2.8% this year. We expect the BCCh to hold the policy rate at 4.5% in the January 27 monetary policy meeting and end the cycle at 4.25% in June.