2026/02/06 | Andrés Pérez M., Vittorio Peretti, Andrea Tellechea & Ignacio Martínez

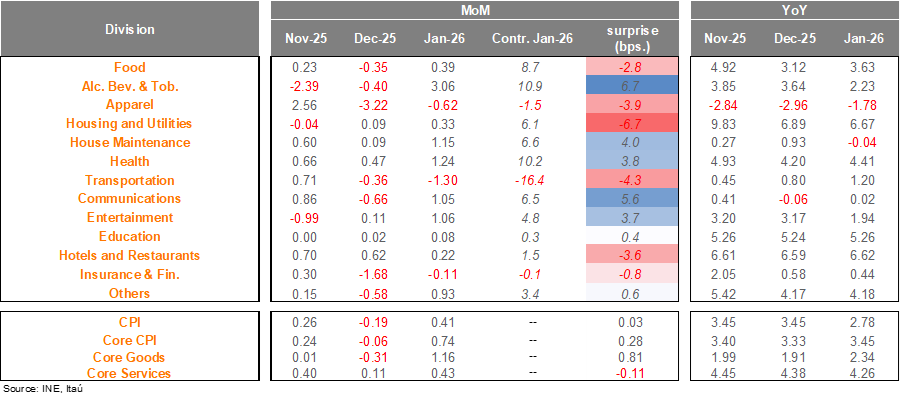

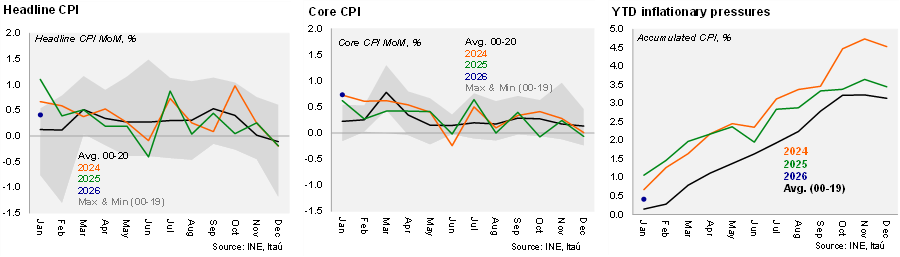

According to the INE, the consumer price index rose by 0.41% MoM in January (Bloomberg median 0.4%, Itaú: 0.38%). While the headline print was essentially in line with our view, core inflation rose by 0.7% MoM, above our 0.5% call, driven mainly by a 1.2% MoM rise in core goods. On an annual basis, inflation fell to 2.8% (3.5% in December) aided by base effects amid the lack of an electricity price adjustment. This is the first time since March 2021 that annual inflation is below the 3% target. Core inflation reached 3.4% YoY (3.3% in December). A key price pull in the month was condominium fees (4.5%), likely reflecting seasonal factors but may also consider lagged second round effects of prior minimum wage hikes and cost pressures. On the core goods front, computers (+8% MoM) and mobile devices (1.2% MoM) played an important role, along with new vehicles (0.8%).

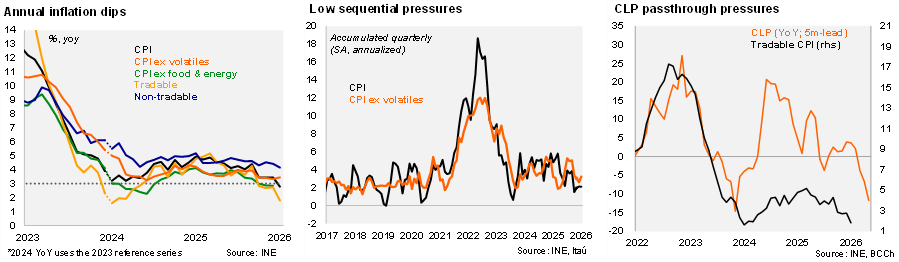

Sequential pressures still low. At the margin, annualized inflation accumulated over the January quarter reached 2.1% (in line with 4Q; 3.8% in 3Q), while core inflation sat at 3.2% (core goods 1.6%, core services 4.8%).Volatile inflation dropped 2pp from December to 1.7%. Food inflation sits at stable 4.1%, while energy inflation fell 6pp from December to 0.2% amid falling gasoline prices and the absence of an electricity hike. Excluding food and energy prices, inflation was broadly stable at 2.7%. Nominal wage data for December eased to 5.9% from 7.8% by the close of 2024.

Our take: Headline inflation fell below the 3% target, as expected, but core dynamics still merit caution. We expect inflation to average 2.7% this year with risks titled to the downside amid recent CLP dynamics. Core inflation continues to show signs of greater stickiness, with items within the basket reflecting upside price pressure that could be linked to the accumulated of higher cost pressures in recent years (minimum wages and electricity). In fact, the large monthly increase in core goods seems counterintuitive considering the sustained CLP appreciation since September. With the favorable terms-of-trade shock underway, we expect the Chilean economy to consolidate its recovery, growing by 2.6% this year (with risks tilted to the upside). An investment recovery that transcends the mining and energy sectors would have a greater marginal effect on the labor market, boosting real wage bill dynamics and consumption growth. The incoming administration has targeted easing permitting processes in the construction sector to reignite activity. The faster-than-expected disinflation underway, compared to the BCCh’s scenario, will likely result in a March rate cut to 4.25%. However, we do not expect the cycle to extend beyond 4.25%. Monetary policy is within the neutral range and comes after a prolonged battle at converging inflation to the target. The swift CLP recovery will drag volatile goods prices down, but the terms-of-trade led economic rebound will likely boost medium-term inflation pressures. The BCCh will receive one additional CPI print ahead of the March meeting. At the January meeting the Board already evaluated a 25bp rate cut. The INE will publish the February CPI data on March 6. We preliminarily expect an increase of 0.2% with downside risks (0.4% in February last year).