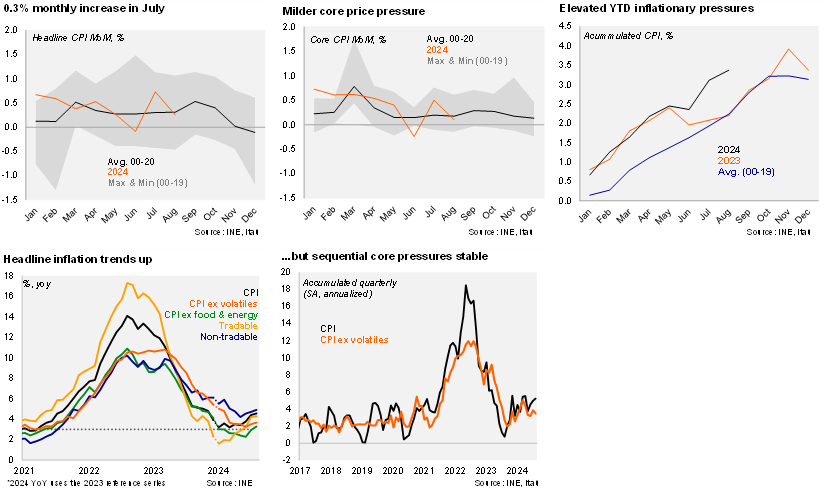

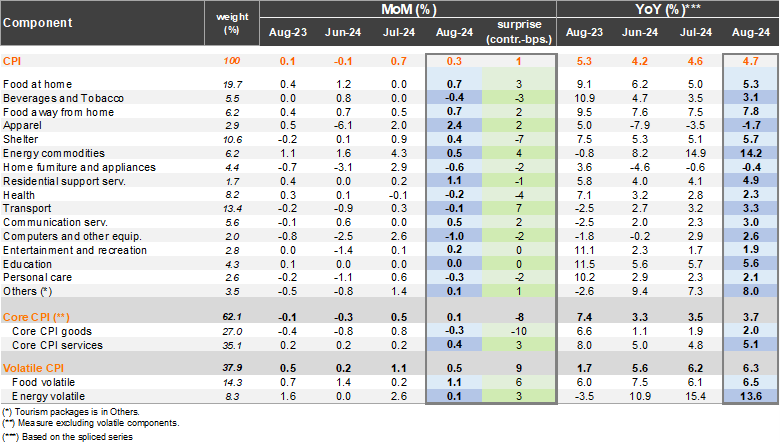

Consumer prices rose by 0.26% from July to August, slightly above the Bloomberg market consensus (0.2%), while essentially in line with our call and market pricing (0.24%). With the print, annual inflation in the reference series reached 4.6% YoY (from 4.4% in July). CPI excluding volatiles rose by 0.1% MoM (-0.1% in August last year; 0.5% MoM in July), with differing dynamics across core goods (falling 0.3% MoM) and services (up 0.4%). On an annual basis, core CPI rose to 3.7% (reference series) from 3.4% in the previous month. Volatiles rose by 0.5% MoM, taking the annual variation to 6.3% (+10bps from July). While our headline CPI forecast was broadly in line with the actual print, a smaller decline in transport prices was offset by a milder increase in shelter. The key upside driver in the month came from the food division (+0.5% MoM; +11bp contribution). Overall, well-behaved core price dynamics consolidate the view that the central bank will continue to cut rates ahead.

Diverging sequential pressures. Tradable prices increased 0.2% MoM, leading the annual tradable variation to rise by 10bps to 4.3% YoY. Year-to-date, the USDCLP has been 15% weaker compared to the equivalent 2023 period. Food prices rose 0.5% MoM, accumulating 2.9% this year. Separately, energy prices rose a mild 0.1% in the month (with the lack of gasoline price variations and no electricity adjustment). Non-tradables increased 0.3% MoM, and 4.9% YoY (reference series; +0.2pp from July). At the margin, we estimate that inflation accumulated in the quarter was 5.2% (SA, annualized), up from 4.5% in 2Q24. Meanwhile, core inflation rose a milder 3.5% (SA, annualized, 3.2% in 2Q24).

Our Take: Even though inflation in August was essentially in line with our call, our 4.5% year-end call is biased to the upside, mainly driven by the risks of greater exchange rate pass-through to tradables and a larger-than-anticipated electricity adjustment in October. Nevertheless, core inflation dynamics are well-behaved and with medium-term inflation expectations anchored, the labor market loosening and global financial conditions set to ease, we expect the BCCh to cut by 25-bps in each of the remaining meetings this year, ending the year with the policy rate at 5.0%. The INE is scheduled to release September’s CPI on October 8. We preliminarily expect an increase of 0.2-0.4%.