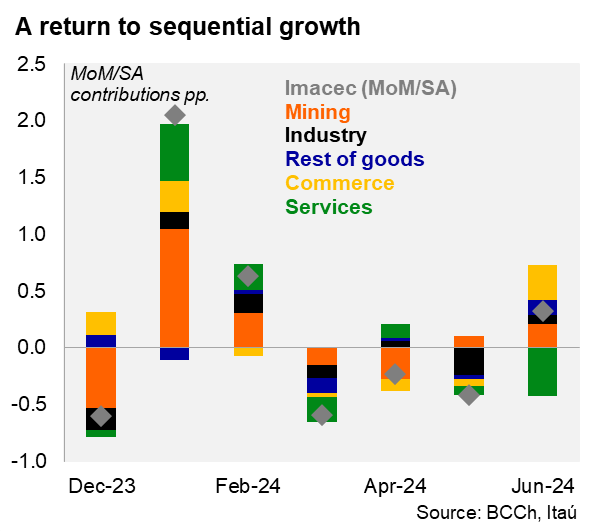

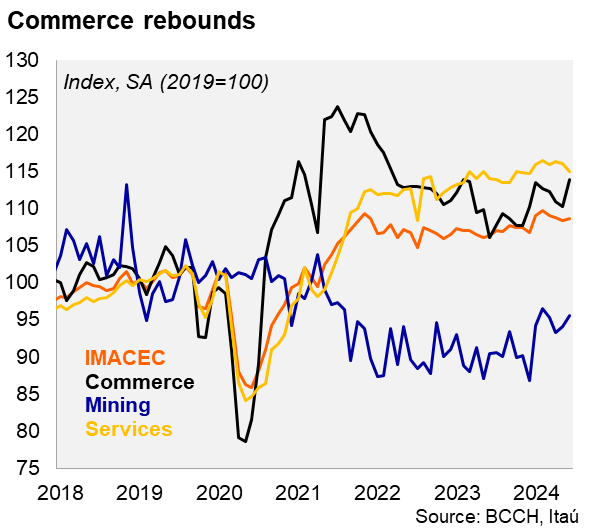

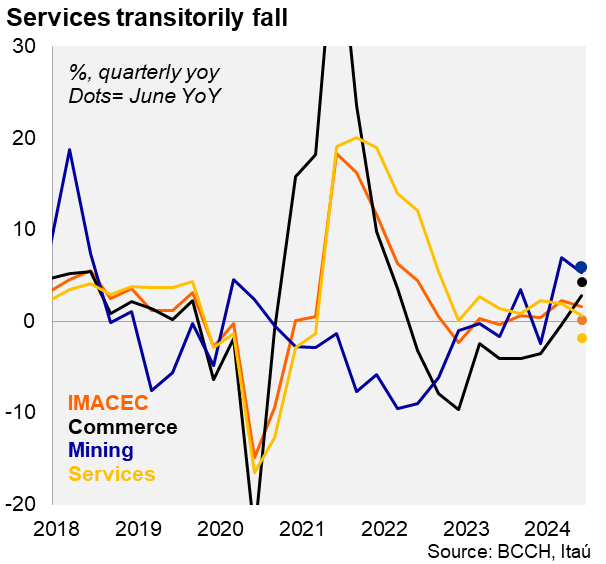

According to the Central Bank, the Monthly Index of Economic Activity (IMACEC) rose 0.1% YoY in June (1.1% in May), well below the market consensus (1.5%) and our call (1.8%). The annual growth print was even below the minimum of the range of market expectations, which were more dispersed than usual (0.6% - 2.2%). Non-mining activity contracted 0.7% YoY (0.2% previously). The month of June had one fewer working day compared to last year. The surprise in the month was driven by a significant contraction in personal services, particularly education, which contracted due to the effect of the early winter vacation and the suspension of classes in certain regions (due to heavy rainfall). These factors are transitory and should revert in August. The annual gain, however, was boosted by Cyber Day incentives (occurring in May 2023), which boosted commerce growth to 4.3% YoY (0.3pp contribution). Mining rose by 5.9% YoY (+0.7pp), lifted by lithium. Other goods production rose 2.1%, favored by the effects of greater rainfall on hydro-electric generation. In seasonally adjusted terms, the IMACEC grew 0.3% MoM SA in June, interrupting three consecutive monthly contractions since March (-1.2pp accumulated). If the economy maintains the level of June towards the end of the year, GDP would expand by roughly 1.7% YoY (0.6% in 2023).

IMACEC rose by 1.6% YoY in 2Q24, well below the 2.6% expected by the central bank in its June-24 IPoM. Non-mining rose by 1.0% (1.5% in 1Q). Services growth ticked down 1.3pp to 0.6%, while commerce rebounded 3.2pp to grow 2.8% YoY. Mining remained a key pull, rising 5.3% YoY (7% in 1Q), along with other goods (particularly electricity generation) growth of 3.8%. At the margin, the 2.3% qoq/saar contraction was dragged by mining (-4.4%; +32% in 1Q), while the 2.0% qoq/saar decline of non-mining activity was affected by declines in all divisions. Manufacturing dropped 4.1% qoq/saar, commerce fell 3.9% and services dropped 1.2%.

Several indicators suggest a moderate improvement ahead. While outstanding real commercial loans in Chile fell again in June, contracting by 1.69% YoY (-3.4% in May; -8.53% in June 2023), there were signs of improving dynamics at the margin. Imports of capital goods and consumer goods during the first few weeks of July posted growth after numerous months of declines. The recovery of employment in construction and real-estate industry also suggests the worst of the investment adjustment has unfolded. In parallel, business confidence, as measured by the IMCE, rose by 1.5pp from June to 45.3 in July, just below the maximum reached in March of this year (46.3), and nearer to the neutral level (50; below since February 2022).

Our take: The disappointment in June’s IMACEC was mainly due to transitory factors yet should be viewed in the light of the overall loss of momentum during 2Q. The reversal of transitory factors in July, and signs that activity dynamics at the margin may be gradually recovering should support an improvement. Nevertheless, we will revise our 2024 growth forecast down this year, currently at 2.8%. If activity in July recovers the levels lost between March and May, and remains at that level for the remainder of the year, the economy would grow 2.2% this year. Looking ahead, the Central Bank will publish the National Accounts for the second quarter on August 19, and the IMACEC for July will be released on September 2.

|

|

|

Andrés Pérez M.

Vittorio Peretti

Ignacio Martinez Labra