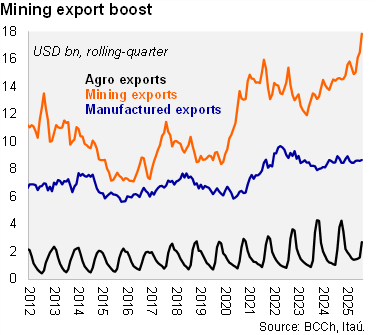

2026/01/07 | Andrés Pérez M., Vittorio Peretti, Andrea Tellechea & Ignacio Martínez

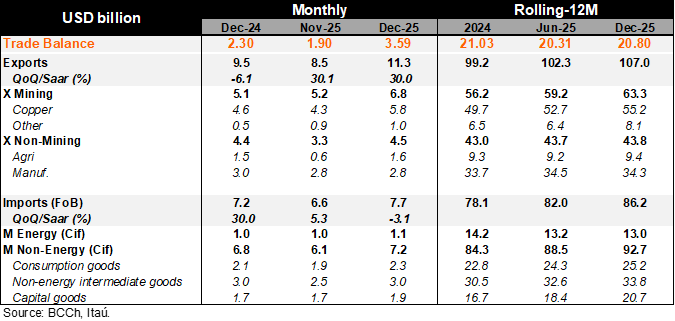

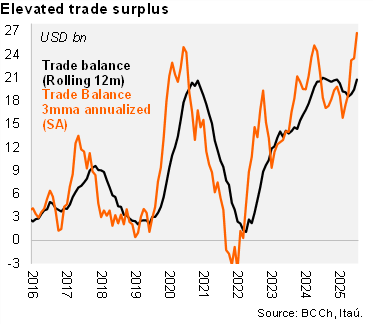

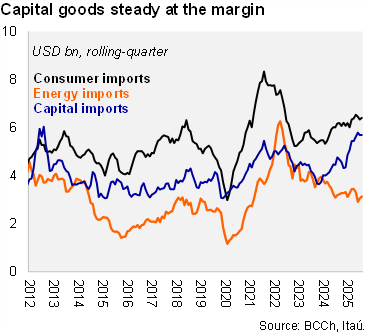

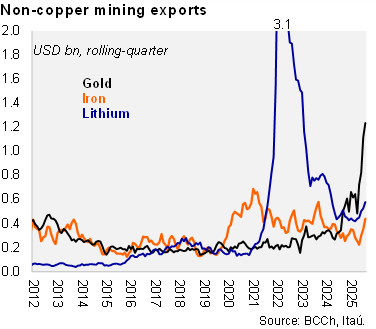

A trade surplus of USD 3.6 billion was recorded in December. As a result, the trade balance reached USD 20.8 billion last year (Itaú: USD 19.2 billion; USD 21 billion in 2024). The annualized quarterly trade balance sits at a higher USD 27 billion as mining exports rebound. Exports grew 18.7% year-on-year in December (8.2% in November), boosted by the 34.2% mining gain. Exports totaled USD 107 billion in 2025 (up 7.9%). Copper exports totaled a historic USD 5.8 billion in December and USD 55.1 billion during 2025 (USD 49.7 billion in 2024). Gold exports reached a historical high of USD491 million in December (+300%; USD 3.2 billion in 2025), while lithium exports in the month sat at USD191 million (USD 1.9 billion in 2025). Agriculture and fishing exports rose 11% in December and 1.0% last year, with the seasonal cherry boom up 10% in the final month of the year (USD 1.3 billion). Manufacturing exports grew by 2% in 2025, boosted by food and chemical exports. On the import side, total imports increased by 6.6% YoY (0.6% in November). During 2025, imports totaled USD 86.2 billion (up 10.3% from 2024 amid the domestic demand recovery). Capital goods increased 7.7% in December, resulting in a USD 23.8% increase during 2025. With levels of capital goods around historic highs, a further boost at the margin going forward is not expected to be of a significant magnitude. Consumer goods rose 9.5% YoY during the final month of the year and 10.2% during 2025. While energy imports rebounded in December (boosted by diesel and gas), low global energy prices during the year lead to an overall drag of -8.6% last year.

Our Take: Still elevated terms-of-trade will sustain a large trade surplus in 2026, offsetting the gradual recovery of domestic demand. Risks tilt towards a CAD last year that is somewhat smaller than our 2.6% call (1.5% in 2024). Additionally, the current copper price rally places a downside bias to our 2.4% of GDP current account deficit forecast for this year.