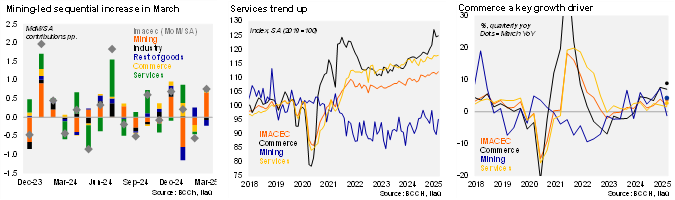

The monthly GDP proxy increased by 0.8% MoM/SA from February to March, the largest increase since July 2024 (1.9%), pulled up by mining (+6%), leading to annual growth of 3.8% (Itaú: 3%; Bloomberg: 3.1%; February: -0.1%). The sequential mining rebound in March follows two months of declines that summed close to 9%. Excluding mining, the economy increased by a milder 0.1% MoM/SA (-0.4% in February). Adjusting for seasonal and calendar effects, the annual increase of non-mining activity was 2.8% in March (-1pp compared to the NSA series), as the additional working day helped boost the original growth figures. Commerce remains at elevated levels, ticking up 0.3% MoM/SA, and resulting in annual growth of 8.9% YoY. Services also rose at the margin, mainly due to personal services.

Activity rose by 2% YoY in 1Q25, above the 1.6% implied in the 1Q25 IPoM scenario, but down from the 4% registered in 4Q24. During the quarter, commerce played a key role, rising 7.1% (7.7% in 4Q24), aided by the inflow of consumer tourism from Argentina. Services increased 1.6% YoY (2.1%), while mining registered a weak quarter, contracting 1.2% (+7.3% in 4Q24). At the margin, the economy increased 2.2% qoq/saar (1.9% in 4Q24), with non-mining growing at 4.5% (2.8% in 4Q24). Sequentially, the activity boost stemmed from a 20% qoq/saar increase in commerce, offsetting the double-digit mining decline. Services grew at a brisk 3% qoq/saar (similar rate to 4Q24).

Our Take: While the influx of tourists is expected to persist at elevated levels, the marginal effect on growth will diminish as a more demanding base of comparison is reached. April results of business and consumer surveys show somewhat more pessimism over the activity outlook, explained mainly by global developments. The April IMACEC will be released on June 02 (we preliminary estimate growth around 2.5%). If activity remains at March levels for the remainder of the year, the economy would grow 1.8%. We expect growth of 2.2% for this year, with the effects of slower 2H global activity dynamics and a more demanding base of comparison to lead to a domestic slowdown. The BCCh will publish GDP data on May 19. With labor dynamics near the upper bound of NAIRU estimates, activity evolving close to potential and the disinflation path consolidating, we see room for the central bank to lower rates during 2H25, in line with our view of less restrictive global monetary policy.