2025/08/07 | Andrés Pérez M., Vittorio Peretti, Andrea Tellechea & Ignacio Martínez

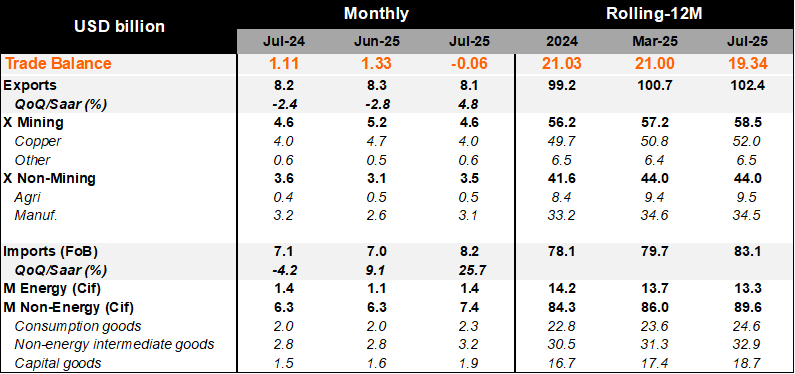

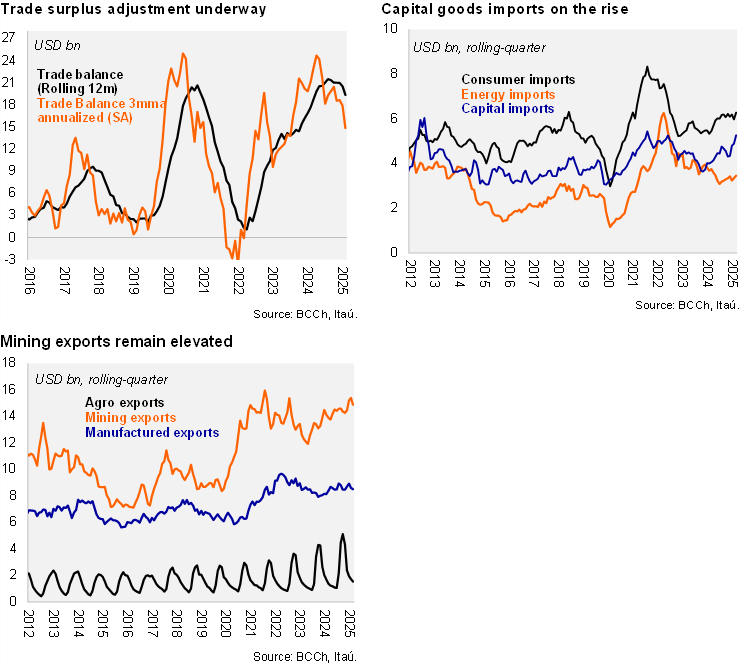

A small trade deficit of USD 62 million was registered in July (Itaú: USD +0.1 billion; Bloomberg consensus: USD +0.5 billion), significantly down from the average monthly surplus of USD 1.9 billion registered during 1H25. The adjustment comes as nominal mining exports retreated by around 10% compared to prior months (boosted by the frontloading of purchases by the USA). Mining exports to the USA fell back to January levels, with the slack not being picked up by China. Manufacturing exports were inferior to July 2024 values (-4% YoY, dragged down by chemicals and paper). In line with the dynamics of previous months, imports continue to perform favorably. Capital goods purchases rose by 34% YoY (with mining and construction machinery continuing to double from July last year) and consumer goods imports up by 15% YoY, consolidating expectations of a further domestic demand recovery. Energy imports were flat over 12-months. The rolling 12-month balance as of July edged down to a still elevated USD 19.3 billion (around 6% of GDP). The annualized quarterly trade balance sits at a lower USD 15 billion as import momentum accelerates (25& QoQ/SAAR).

Our Take: The global growth slowdown ahead, normalization of US copper purchases following the exemption of tariffs and recovering domestic demand will gradually lower the elevated trade surplus. As a result, we expect the CAD to rise by 50bps from last year to 2% of GDP.