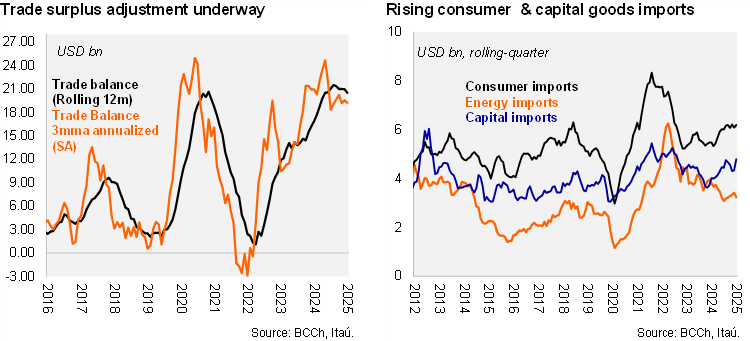

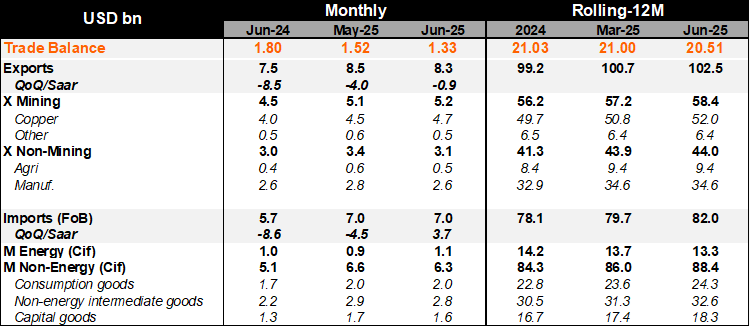

A trade surplus of USD 1.3 billion was registered in June (Itaú: USD 1.5 bn). As a result, an elevated trade surplus of USD 11.7 billion was reached during 1H25 (similar to the corresponding period last year). Copper exports remain the key upside pull, rising 17% YoY in the June (10% YoY during 1H25). In June, copper export growth was linked to China, while the front-loading of sales to the US, ahead of an expected tariff on the sector, seems to have normalized. Total exports rose by 10.6% YoY (6.3% in May). On the import front, both imports of consumer and capital goods continued to increase at swift pace, while the prior drag from energy imports reversed. Total imports increased by 22.2% YoY (8.1% in May). The rolling 12-month balance in June remained elevated at USD 20.5 billion (over 6% of GDP) but is showing the first signs of adjusted down as imports recover. The annualized quarterly trade balance sits at a lower USD 19.2 billion.

Capital goods import dynamics remained upbeat, positive for the investment recovery outlook. Imports continue to reflect improving domestic demand. Capital goods increased 24.4%, sustaining a double-digit growth pace since early 4Q24. Imports of machinery for mining and construction continued to more than double compared to levels from last year. Consumer goods imports increased 19.6% YoY (14.7% in 1Q25), lifted by apparel and durable goods imports. Energy imports posted the first annual increase since December last year, rising by 13% YoY. Gasoline and diesel gains were behind the rebound. Since June, global oil prices have once more adjusted down following the middle east ceasefire.

Our Take: We expect some global growth slowdown ahead, accompanied by a copper price retreat, denting export dynamics and gradually lower the elevated trade surplus. Nevertheless, we still expect a low CAD of 1.9% of GDP this year (-1.5% last year).