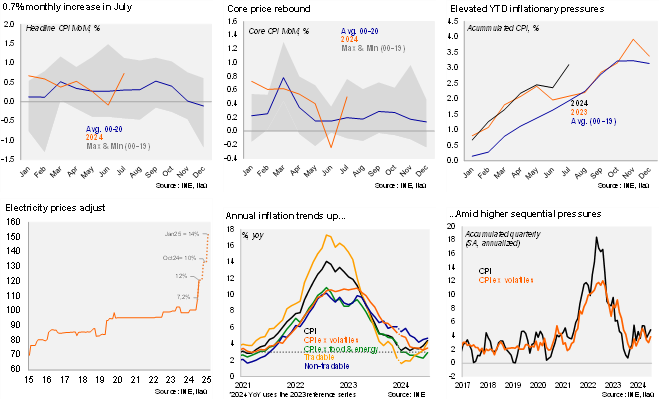

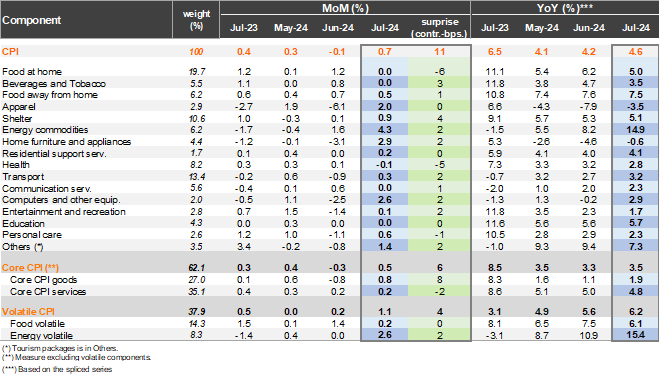

Consumer prices rose by 0.7% MoM in July, above both the Bloomberg market consensus (0.6%) and our call (0.62%), resulting in the annual variation rising to 4.4% (3.8% in June; reference series). A key price driver in the month was electricity, rising 12% (+28bps contribution; above our 10% estimate) as generation prices adjusted. Shelter prices also surprised us to the upside, while international air travel rose 13.5% (+6bps; nearly double our call). The apparel and household maintenance divisions bounced back (2% increases; following June Cyber Day sales). The health and alcoholic beverage and tobacco divisions posted mild price declines, while fuel prices (-6bp contribution) and tourism packages (-3bps) were also drags. Core inflation rose 0.5% in the month (Itaú: 0.4%), leading to an annual variation of 3.5% (reference series; 3.2% in June).

Tradable inflation continues to tick up. Tradable prices increased 0.9% MoM, leading the annual tradable variation to rise 1pp to 4.2% YoY. The USDCLP was, on average, 17% weaker than one year ago during 1H24, and still above last year's level so far in August. Food prices rose 0.1% MoM, and 4.9% YoY (down from 5.8% in June). Separately, energy prices rose 2.5% in the month, as falling fuel prices only partly offset the double-digit electricity price increase. In annual terms, energy inflation rose to 15.3% (+4.4pp from June). Non-tradables increased 0.5% MoM, and 4.7% YoY (reference series; +0.2pp from June). Services lifted the non-tradable pressures, rising 1% MoM and 5.7% YoY (4.8% previously). Excluding volatile items (electricity), the monthly services gain was a far milder 0.2%. At the margin, we estimate that inflation accumulated in the quarter was 4.9% (SA, annualized), up from 4.3% in 2Q24. Meanwhile, core inflation rose to 3.9% (SA, annualized, 3.0% in 1Q24; 5.1% in 1Q24).

Our take: Headline inflation pressure will continue to rise as further electricity price adjustments are expected later this year and in early 2025. We expect inflation to end the year at 4.5% (above the central bank’s 4.2% call). In this context, we expect the Board to remain cautious as inflation expectations may continue to rise (trader survey’s two-year outlook: 3.1%). Nevertheless, weak activity dynamics in 2Q and consolidating expectations that the Fed should cut rates several times this year may permit additional easing. We see a yearend policy rate of 5.5% (one additional 25bp cut during 2H24). INE will publish August’s CPI on September 6, which we estimate at +0.1-0.2%. The next monetary policy meeting will be held on September 3, with the IPoM published the following day.