2025/08/01 | Andrés Pérez M., Vittorio Peretti, Andrea Tellechea & Ignacio Martínez

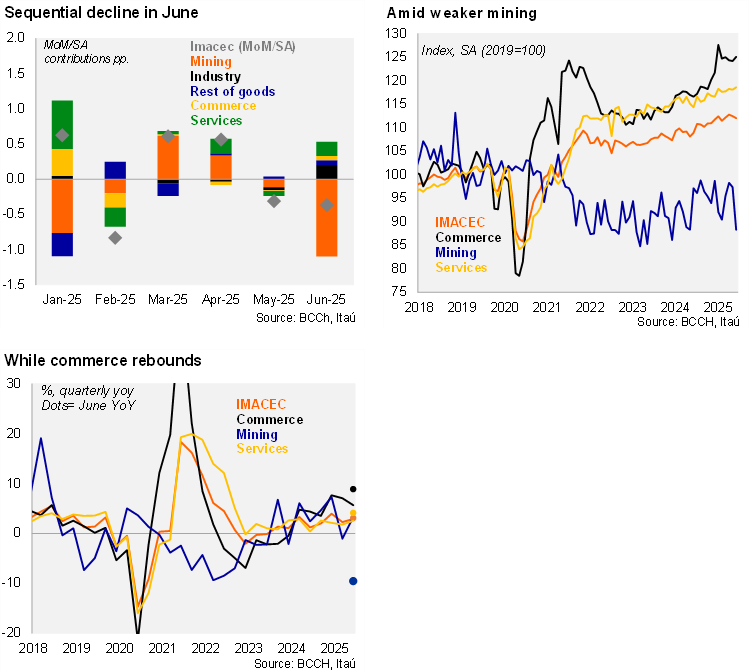

The GPD proxy (Imacec) increased 3.1% YoY in June (3.2% in May), below both the Bloomberg market consensus of 3.7% and our 3.4% call. The economy contracted 0.4% MoM/SA, dragged by the transitory mining slump (-9.3% MoM /SA). However, non-mining activity jumped by 4.8% YoY, on the back of a 0.8% MoM/SA increase (-0.2% in May), the highest sequential rise since January 2025 (1.6%), and with all sectors positively contributing to activity. The positive year-on-year result was explained by services, especially education, mainly due to a low comparison base caused by class suspensions recorded in 2024. To a lesser extent, business services also contributed positively to the activity's results. In contrast, mining production (-9.6% YoY) partially offset the annual result, and accounted for most of the decline in the Imacec in seasonally adjusted (-9.3% MoM/SA; -1.1pp of contribution), in line with the closure of a mining plant for maintenance as, pointed out yesterday in sectorial data from INE.

The Chilean economy grew 2.9% YoY in 2Q25 (IPoM: 3.1%; 2.3% in 1Q25) and registered the fourth consecutive quarterly sequential gain. Mining rebounded with a 3.3% YoY increase, reversing the 1% contraction seen in 1Q25. Non-mining sectors expanded by 3% (2.8% in 1Q25), led by the 5.7% annual commerce increase (7.1% in 1Q25), as elevated real wage growth and the influx of consumer tourism sustain the upside pull. Services rose by an elevated 2.6% YoY. On a sequential basis, activity momentum slowed to 1.4% QoQ/SAAR (3% in 1Q25) but builds on three prior quarters of upbeat growth. Non-mining sectors grew by 0.5% QoQ/SAAR (5.3% in 1Q25). Business confidence levels (IMCE) at the start of 2H25 continued their upward trend observed throughout the year, key to consolidating the recovery investment recovery. Year-to-date imports of capital goods have increased by 20% YoY. Developments on the trade front, at the margin, have been positive with the United States excluding refined copper from tariffs and retaining the minimum 10% on other Chile exports. Following significant frontloading, fiscal spending is being reeled in, as we had expected. While the marginal contribution from consumer tourism is set to fade amid a more demanding base effects in 2H25.

Our Take: Looking through the transitory June mining slump, today’s data shows that the economic recovery remains on course, consolidating a closed output gap. If activity remains at 2Q25 levels for the remainder of the year, the economy will grow 2.1%, while non-mining will grow by 2.5%. We expect GDP growth of 2.6% this year, lifted by recovering mining-related investment and private consumption. The retreat in inflation and interest rates, along with elevated terms-of-trade will also support growth. Yet, as transitory boosts to the economy in 1H25 fade (fiscal, tourism), growth momentum is set to slow ahead. We expect average QoQ/SA growth of 0.4% in 2H (down from 0.6% in 1H). Notably, activity dynamics contrast with persistent labor market slack, likely due to the significant increase in labor costs during the last few years. The BCCh will release updated national accounts data for 2Q25 on August 18. We expect the Central Bank to cut the MPR to 4.25% by yearend amid growth labor market slack, anchored inflation expectations and a closed output gap. Nevertheless, risks tilt towards a more gradual rate cut cycle.