2025/11/07 | Andrés Pérez M., Vittorio Peretti, Andrea Tellechea & Ignacio Martínez

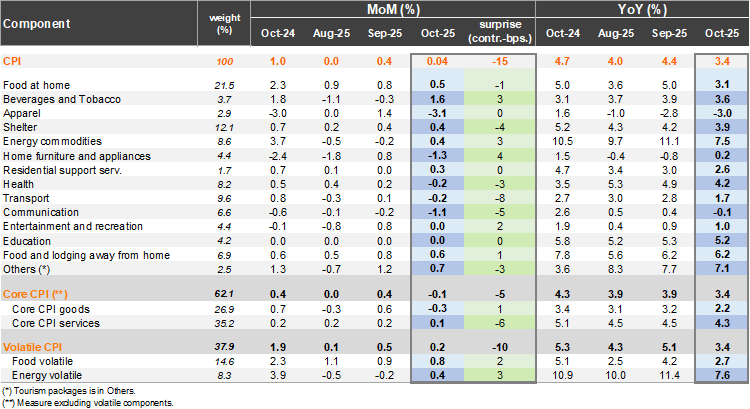

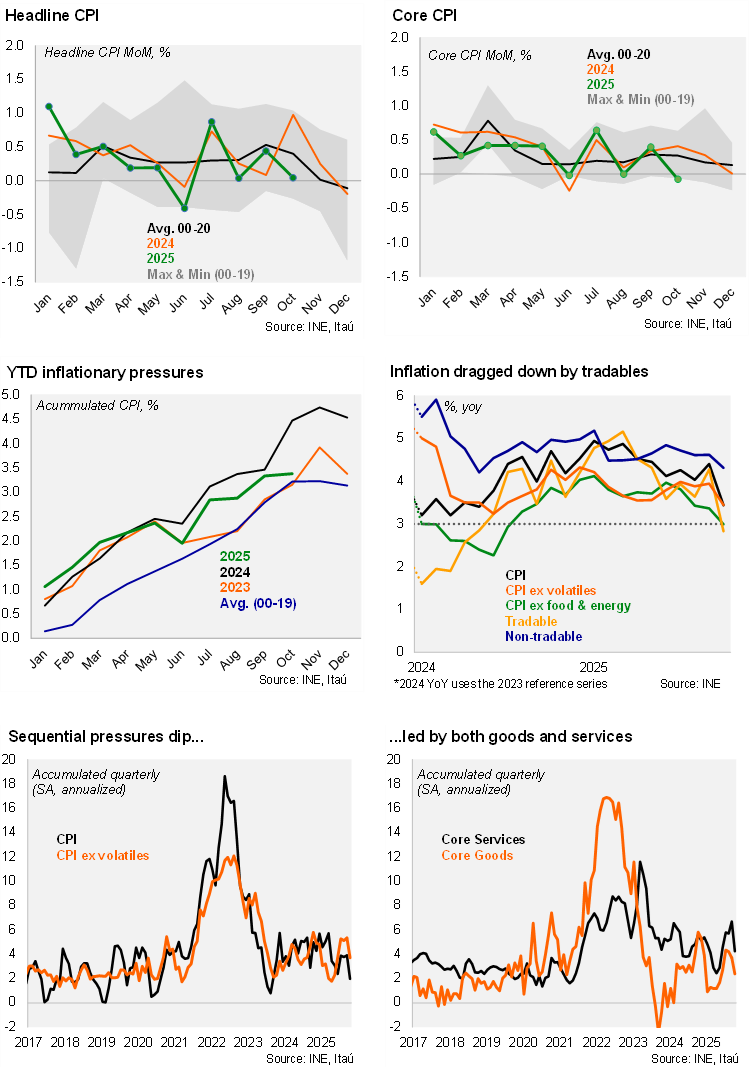

According to the INE, Consumer Price Index (CPI) in October rose by only 0.04% from September, below the Bloomberg market consensus (0.3%) and asset prices (0.22%), and our 0.19% call. The October monthly inflation last year came in at 1%, affected by the large electricity price adjustment. As a result, the annual CPI variation fell sharply from 4.4% in September to 3.4%. Core CPI (ex-volatiles) fell by 0.1% from September (Itaú: 0%), leading to an annual print dipping to 3.4% YoY. Key drags to the monthly inflation print stemmed from bread (-2,0%), private passenger Transport (-6,8%), along with cyber-related sales (apparel: -3.1% MoM; Home appliances: -1.3%; cellular phones: -3.3%), that are expected to revert in November. Upside pressures in the months came from the food and beverage division (0.5%) and community living fees (4.3%). The largest downside surprises relative to our nowcast came from transportation, particularly international air travel.

Sequential core pressures retreat. Annual core goods inflation dropped 1pp to 2.2%, with core services ticked down 0.2pp to 4.3%. Volatile inflation declined by a significant 1.7pp to 3.4%, explaining the bulk of the overall adjustment. Excluding food and energy prices, inflation dropped by 40bps to 3.0%. Sequentially, annualized headline inflation accumulated during the last quarter reached 2% (2.4% in the June quarter), the lowest since late 2023. Core pressures ticked down to 3.7% (5.3% in the September quarter, while in line with the June quarter). Within core inflation services sits at 4.3%, down from recent peaks that neared 7%. Core services rose 0.1%, following two months of contained 0.2% MoM gains. Meanwhile, real wage data for September also showed a significant deceleration. One of the main sources of recent concern has been the extent of passthrough from higher wages to inflation dynamics.

Our Take: Inflation during 3Q25 was slightly below the BCCh’s baseline scenario outlined in the IPoM, while the soft October print likely further eases some of the inflation risk concerns. The Central Bank Board expectedly held the policy rate at 4.75% in a unanimous vote in October and retained the forward guidance of needing to accumulate more data before embarking on its next move. Next week’s minutes will provide additional clarity on the policy options discussed in the meeting. We expect the Board only discussed holding yet might signal an option of cutting was swiftly dismissed, thereby opening the door for a potential December cut. In September, the Board only considered staying on hold. The rate curve at yesterday’s close priced in 9bps of cuts. Following today’s print, we expect the odds for a December movement to increase. The Board will receive one additional inflation print prior to the December meeting. Our preliminary estimate sits at 0.4-0.5% for November CPI, leading to annual inflation reaching 3.6%. Our yearend call is 3.9%, slightly below the BCCh’s 4%. The November print will be released on December 5.