2025/11/18 | Andrés Pérez M., Vittorio Peretti, Andrea Tellechea & Ignacio Martínez

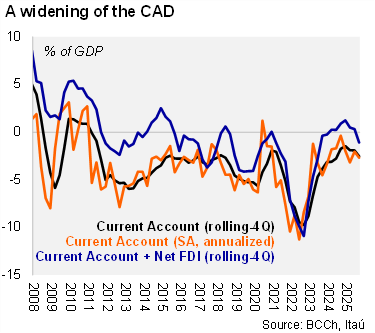

A USD 4.6 billion current account deficit was registered in 3Q25 (Bloomberg consensus: USD 5.0 billion; Itaú: USD 5.5 billion), rising from the USD 2.4 billion deficit in 3Q24, as the goods trade surplus narrowed sharply, in turn driven by the domestic demand recovery. The 2Q CAD was revised down by USD 1.2 billion, in part due to a larger trade surplus. The rolling-4Q current account balance came in at a higher deficit of 2.5% (1.5% in 2024). Sequentially, the CAD in 2Q reached 2.7% of GDP (SA, annualized; 2% in 4Q24). The rising deficit is consistent with the recovery of domestic demand, boosting imports and leading an adjustment of the trade surplus of goods to USD 2.4 billion, (USD 4.8 billion in 3Q24). Nominally, private consumption increased by 7.3% YoY in 3Q, while gross fixed investment rose by 14.4%. Exports increased by 5% YoY (down from 9% in 2Q). The USD 2.3 billion trade deficit in services was in line with 3Q24. Exports were driven by business services, telecommunications, computer and information services, and financial services. Travel services also contributed to the result, in line with inbound tourism in Chile. As for imports, the result reflected the increase in business services, maintenance and repair services, and royalties. Meanwhile, the income deficit is growing (to USD 4.7 billion; USD 4.0 billion in 3Q24) as elevated copper prices boosts FDI investment results. The rise in annual CAD has led to a lower financing coverage by FDI (down to 56%, from 184% in 2024). External debt sits at 78% of GDP, similar to the close of 2024.

Our Take: Improved export performance in early 4Q leads us to expect a CAD of 2.8% of GDP for 2025 (BCCh: 2.6%). The tight copper market should support export dynamics over time, while also sustaining a large income deficit amid favorable FDI investment results. Overall, BoP dynamics reflect an economy far better balanced compared to recent years, permitting the successful advancement of the central bank’s reserve accumulation program. The BCCh’ s international reserves reached USD 48.0 billion (13.9% of GDP as of October (USD 44.4 billion at the close of 2024; 13.4%).