2025/08/18 | Andrés Pérez M., Vittorio Peretti, Andrea Tellechea & Ignacio Martínez

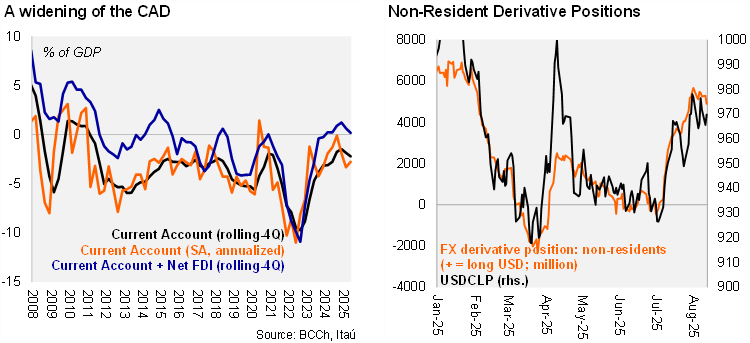

A USD 3.2 billion current account deficit was registered at the second quarter of the year (Bloomberg: USD 2.0 billion; Itaú: USD 2.4 billion call), rising from the USD 1.9 billion surplus in 2Q24. The 1Q balance was revised from a USD 0.6 billion surplus to a deficit of USD 0.2 billion. The rolling-4Q current account balance came in at a still moderate deficit 2.2% (1.5% in 2024; 1.8% as of March). Sequentially, the CAD in 2Q reached 2.8% of GDP (SA, annualized). The rise in the deficit in aligned with a recovery of domestic demand with total consumption growing by 3% YoY and gross fixed investment up by 5.6% YoY in the quarter. As a result, the elevated trade surplus of goods is adjusted down to USD 4.5 billion, (USD 5.3 billion in 2Q24). Exports continue to perform favorably rising by 7.1% YoY (5.2% in 1Q; lifted by copper), but import growth surged to 13.1% YoY (8% in 1Q). Imports of consumer goods rose by 13%, while imports of capital goods increased by 26.5% YoY. The USD 2.4 billion trade deficit in services was in line with 2Q24. Meanwhile, a growing income deficit (USD 5.6 billion, largest since 1Q11) amid elevated copper prices boosts FDI investment results. The annual CAD is comfortably financed by FDI. Net foreign direct investment into Chile (around 2.4% of GDP) comfortably financed the 2.2% CAD. External debt sits at 75% f GDP, down from 78% at the close of 2024.

Our Take: We expected the CAD to widen this year as the domestic demand recovers amid lower inflation, interest rates and high real wage growth.The 2Q upside surprise and revision to 1Q data poses an upside risk to our 2% of GDP call for the year (BCCH: 1.8%). Nevertheless, the CAD remains well-financed and reflects an economy that is balanced, reflected in the announcement of the international reserve accumulation program. The tight copper market will support export dynamics, while also sustaining a large income deficit amid favorable FDI investment results.