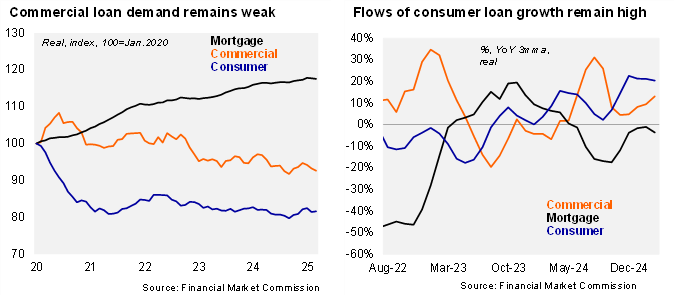

According to the Financial Market Commission, the banking system’s stock of outstanding real loans in Chile fell again in March, declining by 2.26% YoY (+0.28% YoY in March 2024). Outstanding real commercial loans in Chile contracted by 4.95% in March (-1.31% in March 2024), declining on an annual basis since May 2022. Outstanding consumer loans in Chile edged back to positive territory, rising by 0.19% YoY (-1.73% in March 2024), although they have been essentially flat for the past several months. On a flow basis, consumer loans have been rising at a healthy clip for several quarters. The stock of real outstanding mortgage loans in Chile continues to gradually decelerate, rising by 1.28% YoY in March (2.48% in March 2024).

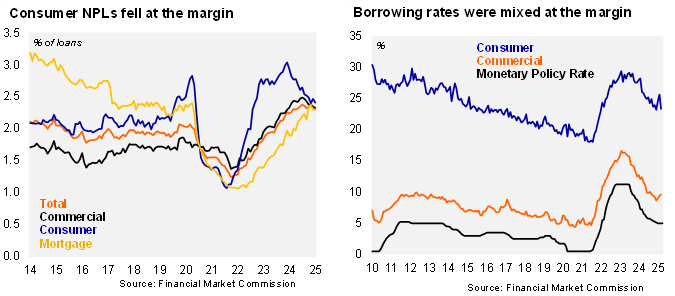

Non-performing loans (defined as delinquencies of more than 90 days) fell slightly at the margin to 2.31% in March (2.24% in March 2024). The banking system’s NPLs still remain well above the March 2014 – March 2020 average of 1.95%. By loan type, consumer NPLs fell from 2.47% in February to 2.41% in March (2.94% in March), down from the cycle peak of 3.04% in February 2024, with the improvement likely linked to lower borrowing costs and improvements in the real wage bill. Mortgage NPLs were sequentially flat at 2.3% in March, well above the 1.9% of March 2025, yet back up to the pre-covid 2.4% level. The gradual rise in commercial NPLs observed in recent quarters appears to have stabilized reaching 2.33% in March (2.35% in February, 2.33% in March 2024).

Borrowing rates for commercial loans rose for the third consecutive month in March. According to the BCCh, interest rates in nominal terms on commercial rose again in March to an average of 9.64%, from 9.41% in February, still well below the 12.47% of December 2023; the spread with respect to the monetary policy rate rose again to 4.64pp, above the two-year average (4.43pp). Rates on commercial loans have increased since the cycle low in December (8.65%). In contrast, interest rates in nominal terms on consumer loans fell to an average of 23.35%, down from 25.64% in February, breaking a streak of two consecutive monthly hikes; the spread with respect to the monetary policy rate rose to 18.35pp, slightly below the two-year average (18.8pp). Inflation-linked rates on mortgages fell at the margin to an average of 4.41% in March, from 4.45% in February.

Loan demand weakened in 1Q25. According to the BCCh’s 1Q25 Banking Credit Survey, answered between March 24 and April 2 (prior to “Liberation Day”), loan demand deteriorated sequentially across all segments, while loan supply remained generally stable. By segment, demand for mortgage and consumer loans fell at the margin, reverting the improvement of the previous survey, broadly consistent with the weakness evidenced in CMF bank credit data through February. Corporate credit demand slumped across all segments, especially in large corporates and real estate. In contrast to the slight deterioration in credit demand at the margin, supply has been essentially stable for the past several quarters.

Our take: Weak commercial loan demand is still a sign of concern. Commercial loan dynamics have yet to signal a meaningful recovery, suggesting the non-mining investment recovery may continue to lag. The Financial Market Commission will release bank credit data for April by the end of May. The Central Bank of Chile will hold their Financial Policy meeting on May 16 and the Financial Policy Report will be published on May 19; we expect the BCCh to maintain the CCyB at 0.5% of RWAs.