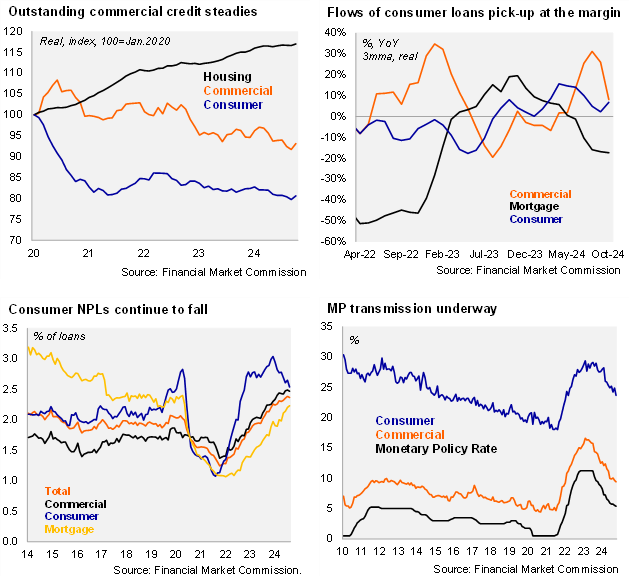

According to the Financial Market Commission, the banking system’s stock of outstanding real loans in Chile fell in October by 1.62% YoY, after declining by 2.64% in September (-2.36% in October 2023). Outstanding real commercial loans in Chile contracted again in October by 4.7% YoY, after plummeting by 5.85% in September (-5.27% in October 2023), declining on an annual basis since May 2022. On a flow basis, commercial loan growth stabilized at the margin after two consecutive months of sharp deceleration. Outstanding consumer loans in Chile improved at the margin, falling by 1.15% YoY, from -1.64% in September (-1.47% in October 2023), contracting on an annual basis since January 2023. Real outstanding mortgage loans in Chile rose by 1.73% YoY, decelerating from 1.92% in September (2.35% in October 2023).

Non-performing loans (defined as delinquencies of more than 90 days) fell slightly at the margin to 2.36% (2.38% in September, 2.07% in October 2023). As such, the banking system’s NPLs remain well above the March 2014 – March 2020 average of 1.95%. By loan type, consumer NPLs fell at the margin to 2.54% (2.65% in September, 2.82% in October 2023), resuming the gradual downward trend that begin in 1Q24; consumer NPLs peaked in the cycle at 3.04% in February, with the improvement likely linked to lower borrowing costs and improvements in the real wage bill. Mortgage NPLs rose to 2.23% (from 2.20%), well above the 1.71% of October 2023, yet still well below the pre-covid 2.4% level. Commercial NPLs were essentially unchanged at 2.47% (2.49% in September, 2.16% in October 2023), close to the highest level at least since 2014, trending up from the low of 1.37% in December 2021.

Monetary policy transmission is still working smoothly in the bank lending channel, as borrowing rates for commercial loans fall further. According to the BCCh, interest rates in nominal terms on commercial loans fell for the second consecutive month in October, averaging 9.42%, down from 9.66% in September, well below the 13.99% of October 2023; the spread with respect to the monetary policy rate fell to 4.02pp, below the two-year average (4.5pp). Rates on commercial loans are the lowest since January 2022 (9.26%). Separately interest rates in nominal terms on consumer loans averaged 23.68% in October, falling from 24.89% in September, and well below the 27.86% in October 2023; the spread with respect to the monetary policy rate dropped to 18.28pp, slightly below the two-year average (18.4pp). We expect the decline in borrowing rates for consumer and commercial loans to slow in the coming months considering a gradual pace towards neutral, as signaled by the BCCh’s guidance. Inflation-linked rates on mortgages fell again in October to 4.54%, from 4.81% in September and down from 4.72% in October 2023.

In its semestral Financial Policy Meeting, the BCCh maintained the Counter-Cyclical Capital Buffer (CCyB) at 0.5% of RWAs … In the second and last Financial Policy Meeting of the year, the BCCh’s Board unanimously decided to maintain the counter-cyclical capital buffer (CCyB) at 0.5% of risk-weighted assets (RWAs). The BCCh originally raised the CCyB as a precautionary measure from 0 to 0.5% of RWAs in May of 2023, which was fully phased in by May 2024, and has maintained it stable since. The decision takes place even as credit dynamics in the economy remains weak and NPLs for commercial and housing loans edge higher. The external front remains the main source of risks to domestic financial stability, as uncertainty persists regarding geopolitical tensions and potential changes to economic and trade policy. Separately, rates at the long end remain elevated, and valuations high. These factors risk deteriorating financial conditions for emerging economies.

… and the Financial Stability Report announced the neutral CCyB at 1% of RWAs. In the Financial Policy Meeting of the first semester, the BCCh called for the banking system to continue strengthening its capital base, and stated they were working on a framework for the implementation of the CCyB, including its so-called “neutral” level. In our view, these messages suggested a neutral level is eventually likely to be set above the 0.5% of RWAs. The IMF (2024), explicitly states “Small open economies and emerging and developing countries (EMDCs) that are vulnerable to external shocks may want to consider higher neutral rates.” The transition to the neutral CCyB is expected to be analyzed in May 2026, once Basel III is fully implemented (end-2025), after which it would be projected in a year’s time (2027).

Our take: Weak commercial loan dynamics remain a source of concern. Credit dynamics have been at the forefront of the monetary policy discussion in Chile, especially considering the relevance that commercial loans may signal for the recovery of investment. The BCCh’s announcement of the neutral CCyB reduces policy uncertainty and should be viewed as part of the BCCh’s broader agenda of gradually strengthening the economy’s ability to weather shocks. The Financial Market Commission will release credit data for November by the end of December.