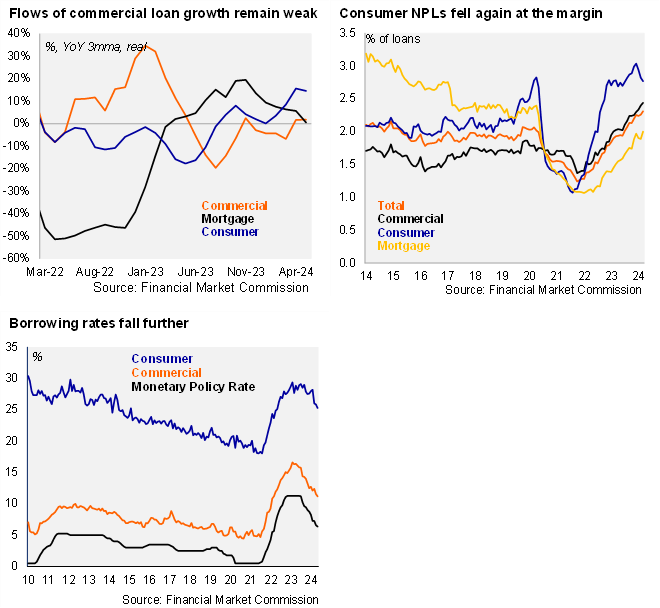

According to the Financial Market Commission, outstanding loans in Chile from the banking system fell by 1.15% YoY in real terms in May, contracting for the second consecutive month (-0.3% in April; -3.09% in May 2023). Outstanding real commercial loans in Chile fell again, contracting by 3.4% in May (-2.67% in April; -5.37% in May 2023), declining on an annual basis since May 2022. Outstanding consumer loans in Chile fell by 1.86% YoY (-0.67% in April, -3.26% in May 2023), contracting on an annual basis since January 2023, and at the margin resuming a downward trend. Real outstanding mortgage loans in Chile rose by 2.5% YoY, essentially unchanged from the previous months (2.56% in April, 1.52% in May 2023).

Non-performing loans (defined as delinquencies of more than 90 days) rose at the margin to 2.31% in May (2.26% in April, 1.93% in May 2023), the highest at least since 2014, defying our expectations of a stabilization. As such, the banking system’s NPLs, they remain well above the March 2014 – March 2020 average of 1.95%. By loan type, consumer NPLs fell again to 2.77% (2.82% in April, 2.78% in May 2023), edging further down from the cycle peak of 3.04% reached in February. The marginal improvement in consumer NPLs in recent months appears consistent with better-than-expected labor market dynamics, and lower borrowing costs, among other factors. Mortgage NPLs rose to a new cyclical peak of 2.0% (1.89% in April, 1.51% May 2023), yet still well below the pre-covid 2.4% level. Commercial NPLs edge even higher, rising to 2.44% in May (2.40% in April, 2.03% in May 2023), the highest level at least since 2014, trending up from the low of 1.37% in December 2021.

Borrowing rates fell in May. Interest rates in nominal terms on consumer loans averaged 24.27% in May, down slightly from 25.84% in April, and the 28.16% of May 2023. Similarly, interest rates in nominal terms on commercial loans averaged 11.18% in May, down from 11.56% in April, well below the 16.09% of May 2023. Even though interest rates on commercial and consumer loans are projected to continue to decline, in line with the transmission of monetary policy (that has accumulated a total of 550-bps in cuts since July 2023), more cautious guidance suggests further declines in borrowing rates are likely to be more gradual. In contrast to the declines in shorter term loans, inflation-linked rates on mortgages rose to an average of 4.97% in May, up from 4.87% in April, and substantially above the 4.23% of May 2023.

Our take: Credit dynamics through the bank lending channel in May call for caution on the projected recovery path, especially due to the contraction in outstanding commercial loans and anemic growth on a flow basis. Weak commercial credit growth was highlighted as a watching point by the BCCh in a text box of its recent Monetary Policy Report, which could crystallize the risk of a persistent delay in the recovery of investment. Separately, in our previous report we flagged the persistent rise in commercial loan NPLs as a watching point, which May’s data reaffirms as a source of concern; in contrast, the decline in consumer NPLs has been in line with our view. On policy, we still expect the BCCh to announce a “neutral” nominal level for the counter-cyclical capital requirement for the banking system (currently set at 0.5% of RWAs) in November 2024. The Financial Market Commission will release data for June on July 31.