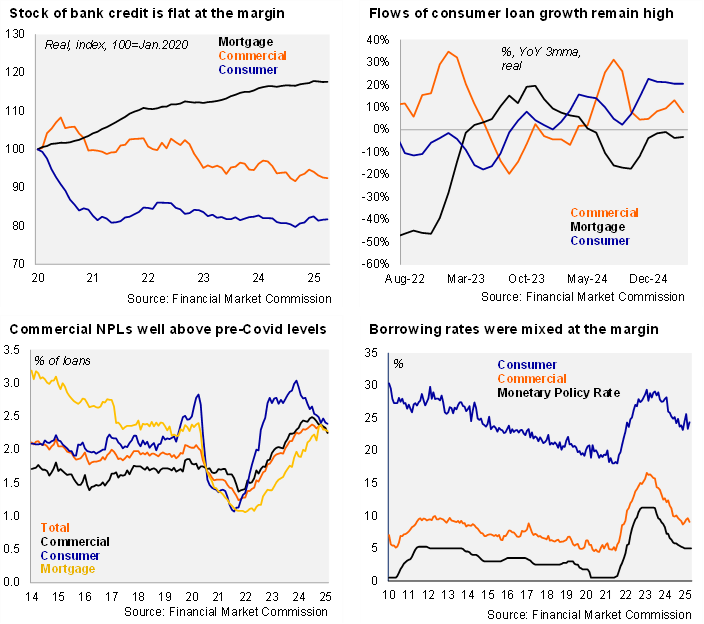

According to the Financial Market Commission, the banking system’s stock of outstanding real loans in Chile fell again in April, declining by 1.62% YoY (-0.3% YoY in April 2024). Outstanding real commercial loans in Chile contracted by 4.07% in April (-2.67% in April 2024), declining on an annual basis since May 2022. Despite the persistent annual contractions, on a flow basis, commercial loans rose by 7.8% YoY in the rolling quarter ending in April, suggesting a gradual recovery may be in the cards. Outstanding consumer loans in Chile were back in positive territory for the second consecutive month, rising by 0.24% YoY (-0.67% in April 2024), although they have been essentially flat for the past several months. On a flow basis, consumer loans have been rising at a healthy clip for several quarters (+20.5% YoY real in the rolling quarter ending in April). The stock of real outstanding mortgage loans in Chile continues to gradually decelerate, rising by 1.20% YoY in April (2.56% in April 2024).

Non-performing loans (defined as delinquencies of more than 90 days) fell at the margin to 2.26% in April (in line with April 2024). The banking system’s NPLs still remain well above the March 2014 – March 2020 average of 1.95%. By loan type, consumer NPLs fell again to 2.39% in April, from 2.41% in March (2.82% in April 2024), down from the cycle peak of 3.04% in February 2024, with the improvement likely linked to lower borrowing costs and improvements in the real wage bill. Mortgage NPLs were essentially flat at the margin at 2.28% in April (2.3% in March), well above the 1.89% of April 2024. Commercial NPLs continue to gradually edge lower at the margin, falling to 2.25% in April (2.33% in March 2025, 2.4% in April 2024).

Bank lending rates were mixed in April. According to the BCCh, interest rates in nominal terms on commercial loans fell in April to an average of 9.06%, from 9.64% in March, well below the 11.56% of April 2024; the spread with respect to the monetary policy rate fell to 4.06pp, somewhat below the two-year average (4.36pp). Rates on commercial loans have whipsawed above 9% since January (8.97%). In contrast, interest rates in nominal terms on consumer loans averaged 24.38% in April, up from 23.35% in January; the spread with respect to the monetary policy rate rose to 19.38pp, above the two-year average (18.9pp). The stabilization of borrowing rates through the bank lending channel in recent months takes place as the BCCh has maintained the policy rate at 5.0%, with cuts signaled later this year. Inflation-linked rates on mortgages fell for the second consecutive month to 4.38%, from 4.45% in February and 4.41% in March.

CCyB unchanged at 0.5% of RWAs, as expected. At its semi-annual financial policy meeting held in mid-May, the BCCh unanimously maintained the countercyclical capital requirement (CCyB) at 0.5% of RWAs, in line with expectations. The Financial Stability Report showed that despite the magnitude of the trade shock, global financial markets, including Chile's, have been able to accommodate these movements and functioned without major disruptions. In Chile, the imbalances of previous years have been corrected, and the financial situation of credit users—households and businesses—has been improving over the last few quarters. At the same time, the banking sector has liquidity and capital levels that would allow it to withstand adverse events, leading the economy in a better position to face a significant deterioration in the global scenario. The BCCh will assess in May 2026 whether it is appropriate to converge to the neutral level of the CCyB (1% of the RWA), which, if activated, would take at least one year to build up.

Our take: Annual contractions in total credit contrast with rising flows. While attention is usually focused on the contraction in outstanding bank credit, increases in gross flows of consumer and commercial loans point to signs of life in credit dynamics. We expect the BCCh to cut the policy rate by another 50bp to 4.5% later this year, which could spur commercial loan demand, especially if the mining investment recovery continues. Pressure on rates at the long end, stemming from global factors, should weigh on mortgage rates and hence demand. The Financial Market Commission will release bank credit data for May by the end of June.