According to the Financial Market Commission, outstanding loans in Chile from the banking system rose by 0.28% YoY in real terms in March, essentially flat from the 0.31% rise in February (-2.55% in March 2023). Outstanding real commercial loans in Chile fell again, contracting by 1.31% in March, declining on an annual basis for more than a year (-5.06% in March 2023). Outstanding consumer loans in Chile fell by 1.73% YoY, down from the -1.16% decline in February (-2.52% in March 2023). In contrast, real outstanding mortgage loans in Chile rose by 2.48% (2.58% in February 2024, 1.31% in March 2023).

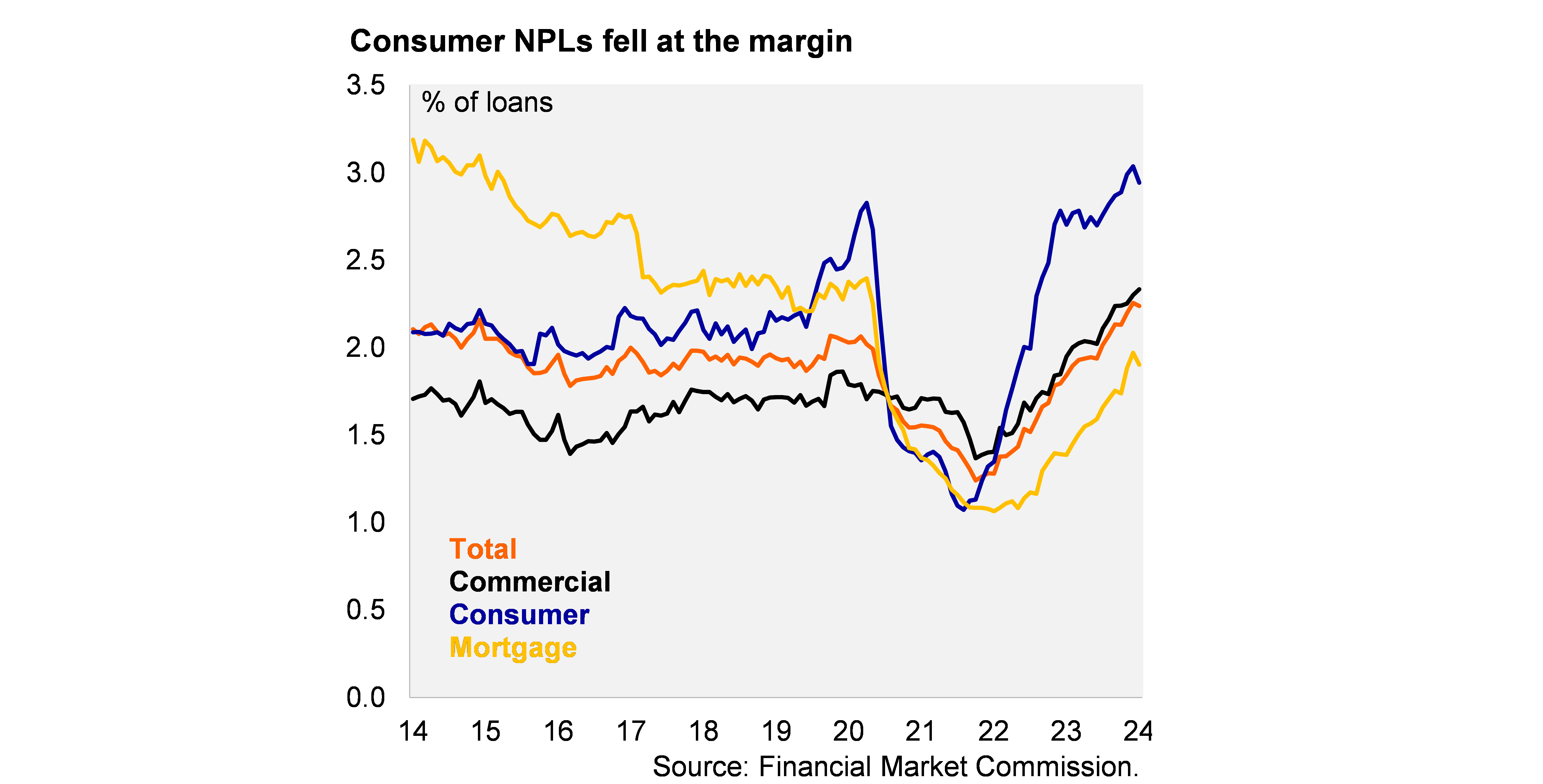

Non-performing loans (defined as delinquencies of more than 90 days) fell slightly to 2.24% in March, down from 2.26% in February, with mixed dynamics across loan types. NPLs remain well above the March 2014 – March 2020 average of 1.95%. By loan type, consumer NPLs fell to 2.94% in March, falling from the cycle peak of 3.04% reached in February, yet above the 2.7% of March 2023. Mortgage NPLs also fell to 1.9% in March, down from the cycle peak of 1.97% in February, still well below the pre-covid 2.4% level. In contrast to the declines in NPLs in consumer and mortgages, commercial NPLs continue to increase, rising to 2.33% in March, up from 2.3% in February, trending up from the low of 1.37% in December 2021.

Interest rates on consumer and commercials loans from the banking system were mixed in March. Interest rates in nominal terms on consumer loans averaged 26.0% in March, down from 28.21% in February, and the 27.66% of March 2023. In contrast, interest rates in nominal terms on commercial loans averaged 12.39% in March 2024, up from 12.08% in February, yet well below the 16.28% of March 2023. Interest rates on commercial and consumer loans are projected to continue to gradually decline, in line with the transmission of monetary policy, that has accumulated a total of 475-bps in cuts since July 2023. Inflation-linked rates on mortgages averaged 4.9% in March, down from 4.97%, yet up from 4.31% in March 2023.

Our take: Overall credit growth remains weak, driven mainly by commercial loans, even as demand for consumer loans begins to pick up. The decline at the margin in NPLs in March, might suggest the lion’s share of the adjustment could be behind, as sequential improvements in the wage bill and lower interest rates support household credit metrics. Separately, the Central Bank will publish the press release of the 1H2024 Financial Policy meeting on Monday May 6, with the Financial Stability Report scheduled for May 7. We expect the BCCh to maintain the countercyclical capital requirement at 0.5% of RWAs.

Andrés Pérez M.

Vittorio Peretti

Ignacio Martinez Labra