2025/09/29 | Andrés Pérez M., Vittorio Peretti, Andrea Tellechea & Ignacio Martínez

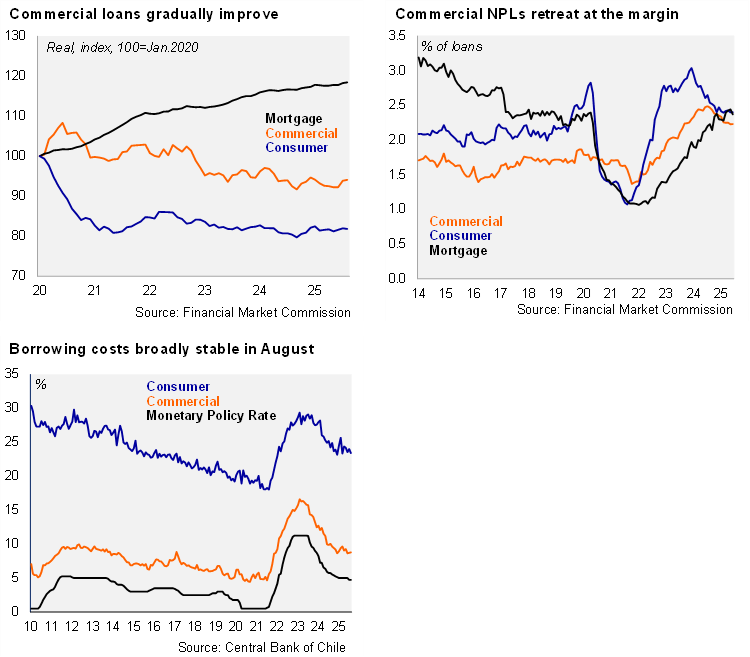

According to the Financial Market Commission, the banking system’s stock of outstanding real loans in Chile increased for the first time since early 2024, rising by 1.13% YoY (-2.04% in August 2024). Outstanding real commercial loans in Chile increased by 0.40% in August (-4.45% in August 2024), ending the run on annual declines that started back in May 2022. Outstanding consumer loans in Chile rose by 1.75% YoY (-2.01% in August 2024). The stock of real outstanding mortgage loans in Chile continued to rise at a slower pace, increasing by 1.14% YoY (compared to 2.09% in August 2024).

Non-performing loans (defined as delinquencies of more than 90 days) ticked down to 2.27% in August (2.35% one year earlier). The banking system’s NPLs still remain well above the March 2014 – March 2020 average of 1.95%. By loan type, consumer NPLs were sequentially stable at 2.40% (2.61% in August 2024), below the cycle peak of 3.04% in February 2024. Mortgage NPLs edged down 7bps from July to 2.37% (2.14% in August 2024). Commercial NPLs remained unchanged from July at 2.23% (2.47% in August 2024).

Bank lending rates were broadly stable in August. According to the BCCh, interest rates in nominal terms on commercial loans ticked up 8bps to an average of 8.79% in August; the spread with respect to the monetary policy rate sits at 4.04pp, below the two-year average of 4.3%. Separately, interest rates in nominal terms on consumer loans averaged 23.41% in August, the lowest rate since March; the spread with respect to the monetary policy rate sits at 18.7pp, similar to the two-year average. Inflation-linked rates on mortgages ticked down 7bps to 4.29%.

Our take: The sequential improvement in credit dynamics is in line with improved business and consumer sentiment and lower average interest rates. The mining-led investment recovery is expected to spill-over into non-mining investment dynamics and credit demand. Room for a significant further decline in borrowing costs is limited considering our view that the Central Bank is near the conclusion of the rate cutting cycle (a 25bp cut expected in December). Global factors that raise concerns of fiscal sustainability and inflationary pressures will likely weigh on mortgage rates and hence demand, despite measures to stimulate the sector. The Financial Market Commission will release bank credit data for September by the end of October.