2025/10/30 | Andrés Pérez M., Vittorio Peretti, Andrea Tellechea & Ignacio Martínez

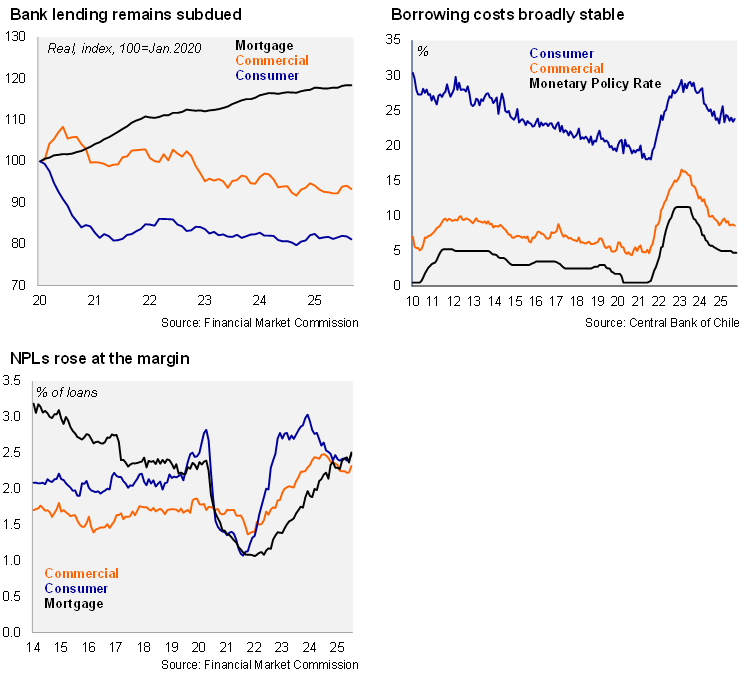

According to the Financial Market Commission, the banking system’s stock of outstanding real loans in Chile rose on an annual basis for the second consecutive month to 1.0% YoY (-2.64% in September 2024). Outstanding real commercial loans in Chile increased by 0.3% in September (-5.85% in September 2024). Outstanding consumer loans in Chile rose by 2.42%YoY (-1.64% in September 2024). The stock of real outstanding mortgage loans in Chile continued to rise at a slower pace, increasing by 1.31% YoY (compared to 1.92% in September 2024).

Mixed demand. According to the BCCh’s 3Q25 Banking Lending Survey released earlier in October, credit conditions remained mostly stable across segments, except for consumer loans, where banks reported stricter standards—25% of banks tightened conditions, and none eased them. In contrast, mortgage credit conditions remained unchanged for 91% of banks. For corporate lending, standards were generally stable, though slightly more restrictive for large companies, while real estate and construction firms saw a modest easing of credit conditions. On the demand side, consumer credit demand showed slight improvement, and mortgage demand strengthened significantly, with 55% of banks reporting increased demand, likely boosted by subsidy measures in place. However, demand from large companies weakened, while SMEs showed mixed signals, with fewer banks reporting a decline and more noting an uptick in demand.

Bank lending rates were mixed in September. According to the BCCh, average nominal rates on commercial loans fell at the margin in September to 8.6% down slightly from 8.79% in August, falling to the lowest since November 2021; the spread with respect to the monetary policy rate fell to 3.85pp, below the two-year average (4.23pp). In contrast, nominal rates on consumer loans averaged 23.8% in September, up slightly from 23.41% in August; the spread with respect to the monetary policy rate rose to 19.05pp, in line with the two-year average. Minor changes in nominal borrowing rates through the bank lending channel in recent months have taken place as the BCCh has signaled a more gradual path towards neutral. Inflation-linked rates on mortgages fell at the margin for the fourth consecutive month to 4.21% in September, from 4.29% in August.

Non-performing loans (defined as delinquencies of more than 90 days) rose at the margin to 2.38% in September (2.38% one year earlier). The banking system’s NPLs still remain well above the March 2014 – March 2020 average of 1.95%. By loan type, consumer NPLs rose sequentially to 2.48% (2.65% in September 2024), below the cycle peak of 3.04% in February 2024. Mortgage NPLs rose to 2.51% (2.2% in September 2024). Commercial NPLs rose to 2.32% (2.49% in September 2024).

Our take: The sequential improvement in credit dynamics is in line with improved business and consumer sentiment and lower average interest rates. The mining-led investment recovery is expected to spill over into non-mining investment dynamics and credit demand. The rise in mortgage loans is linked to the transitory subsidy program. Room for a significant further decline in commercial and consumer borrowing costs is limited considering our view that the Central Bank is near the conclusion of the rate-cutting cycle. The Financial Market Commission will release bank credit data for October by the end of November.