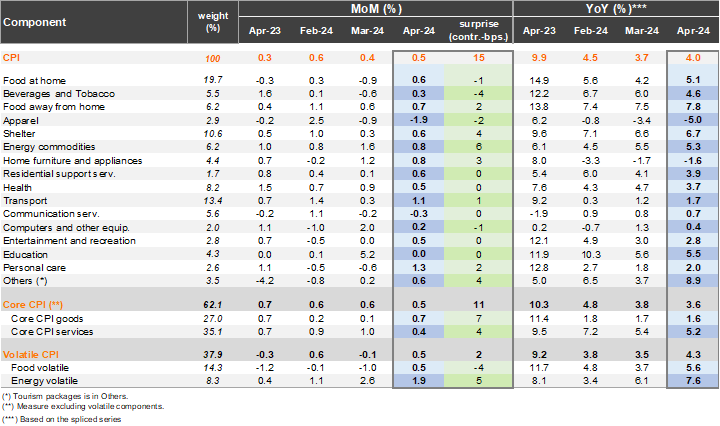

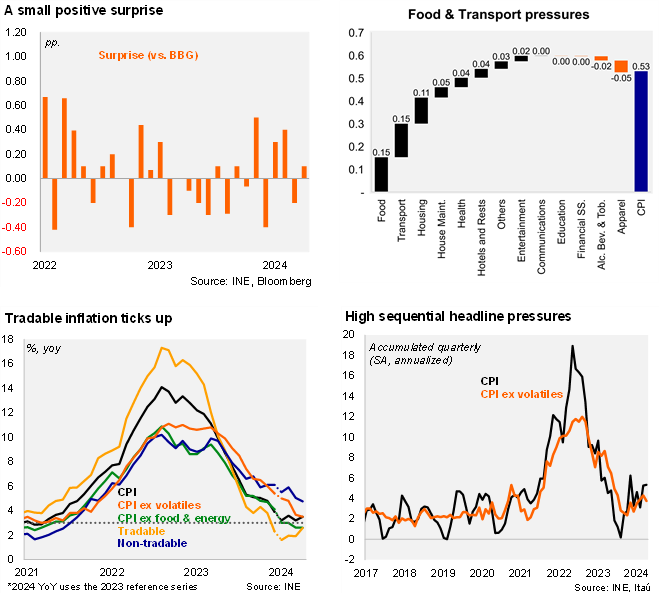

After the downside surprise in March, CPI came in above expectations in April, rising 0.53% from March, above both the Bloomberg market consensus and our call of 0.4%. The bulk of the upside surprise relative to our forecast came from bread, condominium fees and liquid gas. Annual inflation rose 30bps to 4.0% in the spliced series, and by the same magnitude to 3.5% in the reference series. Core inflation also rose 0.5% in the month, leading to a 0.2pp drop to 3.5% (reference series).

Tradable inflation starts to tick up, reflecting the CLP's depreciation in the first months of the year, while services inflation gradually edges down (in line with an output gap that is near closed). Tradables increased by 0.7% MoM, corresponding to a 2.6% YoY increase in the reference series, up 0.7pp from March. Non-tradables increased by 0.3% MoM, but led to the yearly rate falling from 5% to 4.8% (reference series; services -0.2pp to 4.7%). Separately, energy prices rose by 1.9% MoM, as higher gasoline prices filter through (CLP effect and global oil prices), leading to the annual print rising 1.6pp to 7.7%. Food prices rose 0.7% MoM, partly unwinding the 0.9% drop in March, leading to an annual increase of 4.7% (+0.8pp from March). At the margin, we estimate that inflation accumulated in the quarter was 5.3% (SA, annualized), in line with 1Q24, while up from 3.3% in 4Q23. Meanwhile, core inflation reached 3.8% (SA, annualized, 4.3% in 1Q24 and 2.7% in 4Q23).

Our Take: April's inflation print reaffirms the challenges of inflation converging to the 3% target, amid significant supply shocks and indexation. Looking ahead further supply pressures stemming from expected electricity price increases will keep inflation elevated. The recent appreciation of the CLP, amid soaring copper prices, may provide some relief to tradable price pressures. We expect a yearend CPI rate of 4.1%, and for the BCCh to slow the pace of rate cuts (first to 50bps this month and then down to 25bps), amid above target inflation and tighter global financial conditions), before pausing the cycle at 5.25% this year.