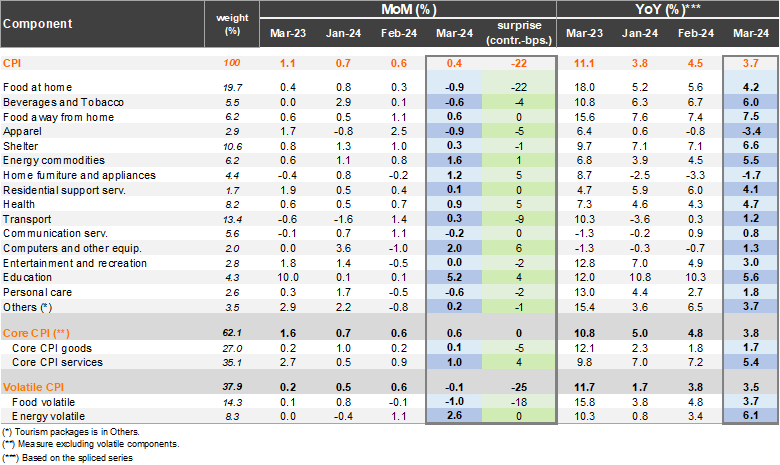

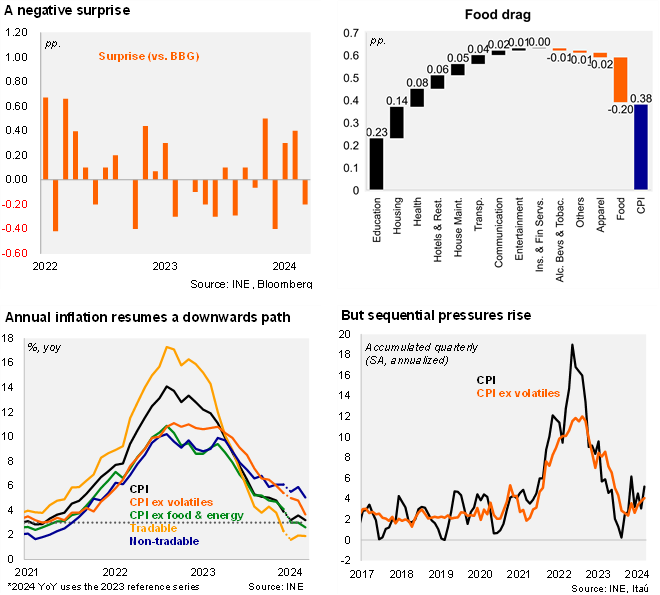

After two large CPI prints at the start of the year, consumer prices rose by 0.38% MoM from February to March, below the market consensus and our call of 0.6%. The BCCh’s IPoM implicit March CPI forecast was 0.49%. The bulk of the surprise to us came from volatile items, particularly volatile foods (falling 1%; 18bps surprise). Importantly, core inflation rose by 0.6%, in line with our expectation. The BCCh’s IPoM implicit March core CPI projection was slightly higher at 0.65%. The education division rose 5.4%, broadly in line with our call. Given the high base of comparison, annual inflation fell 80bps from 4.5% to 3.7% in the spliced series (and down to 3.2% from 3.6% in the reference series). Core inflation dropped 1pp to 3.8%. Overall, cumulative CPI this year has increased by 1.6pp in 1Q24, sustaining the upward revisions to yearend inflation seen year-to-date.

Services inflation pressures remain elevated, but a high base of comparison support a gradual disinflation process. Core services rose by 1% MoM, which translated to 5.4% YoY increase in the spliced series (5.7% in the reference series), down by 1.8pp from February (in part due to the lower education weight in the new CPI basket and the far lower 2023 CPI versus 2022, resulting in milder indexation pressures). Core goods rose by 0.1% MoM, taking the annual print down to 1.7% (1.8% in February; 1% in the reference series). Tradables increased by 0.1% MoM, corresponding to a 2.9% YoY increase (reference: 1.9%), down from 3.1% in February, suggesting that exchange rate passthrough from the CLP’s depreciation appears contained for now. In contrast, non-tradables increased by 0.7% MoM, taking the yearly rate from 6.3% to 4.8% (reference: 5.0%). Separately, energy prices rose by 2.5% MoM, as higher gasoline prices filter through (CLP effect and global oil prices), while food prices fell by 0.9% MoM. At the margin, we estimate that inflation accumulated in the quarter was 5.2% (SA, annualized; from 3.2% in 4Q23. Meanwhile, core inflation reached 4.1% (SA, annualized, 2.6% in 4Q23).

Our Take: The March CPI print validates the IPoM’s scenario. Looking ahead, notable upside risks stemming from electricity price adjustments, continued passthrough from the CLP’s depreciation on tradable items, while sequential employment growth and real wage growth of around 2.5% YoY could stall the services inflation adjustment. We project inflation to end the year at 3.5%, with upside risks. We see the BCCh slowing the pace of rate cuts to 50bps in the May 23 monetary policy meeting, as upside inflation pressures persist, domestic private consumption improves and global financial conditions tighten. We preliminarily expect a CPI increase of 0.2-0.3% MoM in April.