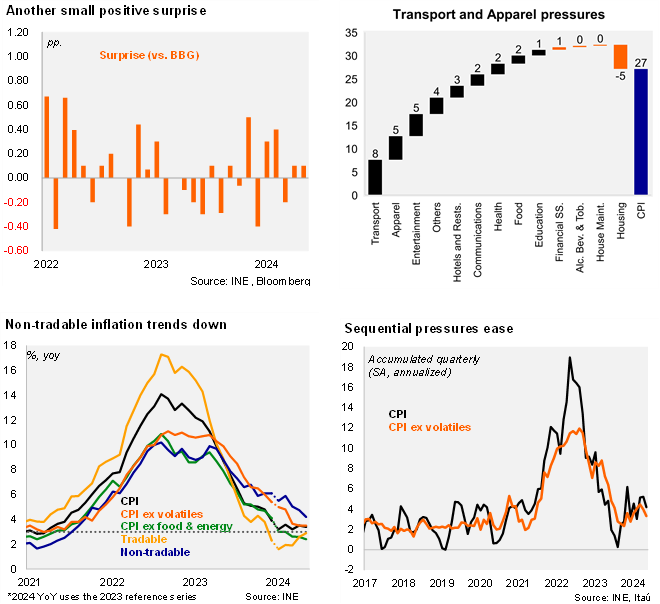

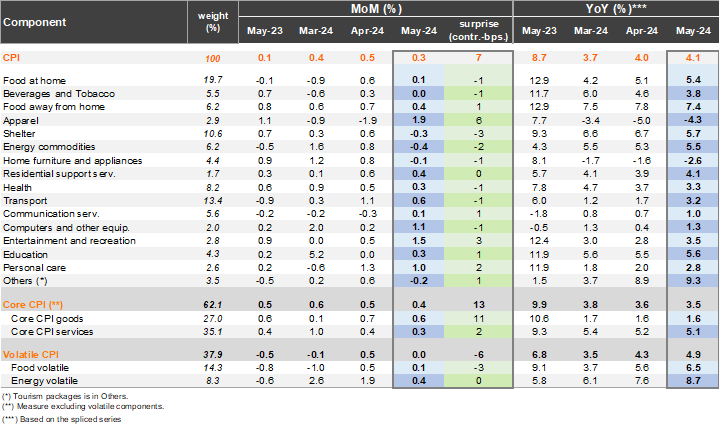

Consumer prices posted another mild upside surprise in May, rising 0.27% from April, above the Bloomberg market consensus and our call, both at 0.2%. The bulk of the upside surprise relative to our forecast came from bread, rent and cellular phones. Key drivers of the monthly gain came from the transportation division, particularly gasoline (+8bp contribution). Rental prices rose 0.4% (+3bps), while the apparel division rose 1.9% (+5bps; expected to unwind in June amid seasonal sales). A key price drag in the month came from the strong payback in condominium fees (-4% MoM in May from +1.7% in April). Annual inflation dropped 0.1pp to 3.4% in the reference series. Core inflation rose 0.4% in the month, leading to a the annual variation being stable at 3.5% (reference series).

Tradable inflation continued to gradually tick up, while services CPI gradually edges down (in line with an output gap that is near closed). Tradables increased 0.4% MoM, corresponding to a 2.9% YoY increase in the reference series, up 0.3pp from April. Separately, energy prices rose by 0.4% MoM, still responding to the effects of prior CLP and global oil prices movements, leading to the annual print rising 1.1pp to 8.8%. We expect gasoline prices to start posting monthly falls from June. Food prices rose 0.1% MoM. Non-tradables increased by 0.1% MoM, leading to a yearly rate of 4.2% (reference series; down 0.6pp from April), with services down 0.5pp to 4.2%. At the margin, we estimate that inflation accumulated in the quarter was 4.2% (SA, annualized), down from 5.2% in 1Q24 (but up from 3.2% in 4Q23). Meanwhile, core inflation reached 3.3% (SA, annualized, 4.5% in 1Q24 and 2.8% in 4Q23).

Our Take: While the appreciation of the CLP since April, amid higher copper prices, may provide some relief to tradable price pressures, one-off adjustments stemming from expected electricity price increases during 2H24 should keep inflation elevated (a factor that was recently highlighted by the Central Bank Gov. Costa as well). Our preliminary forecast for June's CPI is -0.1% MoM, amid falling gasoline prices and the effects from cyber days. We expect a yearend CPI rate of 4.1%. With activity and inflation evolving broadly in line with the central bank’s expectations we expect the rate cut cycle to continue in the near term. We see the BCCh slowing the pace of rate cuts to 25bps this month (providing the BCCh with additional policy flexibility as it approaches neutral and FFR levels), before pausing the cycle at 5.25% this year.