2025/12/05 | Andrés Pérez M., Vittorio Peretti, Andrea Tellechea & Ignacio Martínez

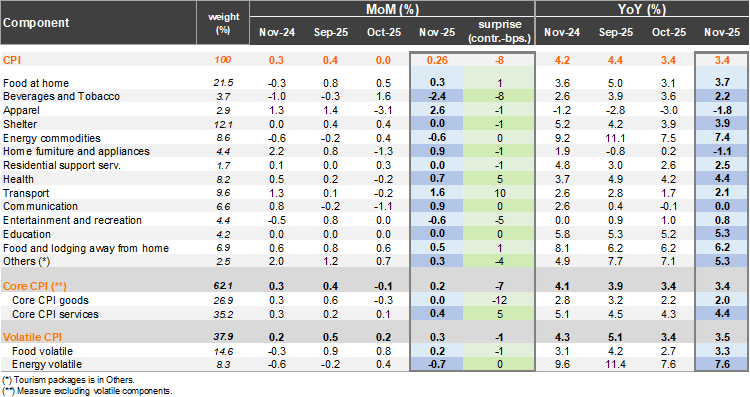

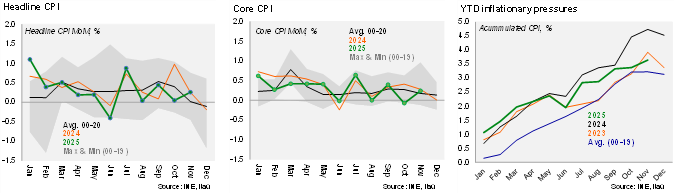

According to the INE, November’s CPI rose by 0.3% MoM, in line with our forecast and the Bloomberg median (0.3%), yet slightly below market pricing (0.37%). On an annual basis, inflation remained flat at 3.4%, remaining within the BCCh’s inflation target tolerance range for the second consecutive month. A key price driver in the month was International Air Travel (28.6%; 0.14 pp. of contribution), while significant price drops were observed in Condominium Fees (-3.8%; -0.06 pp. of contribution), Wine (-6.1%; -0.06 pp. of contribution) and Gasoline (-1.7%; -0.05 pp. of contribution). At the second decimal, inflation was 0.26% MoM, 11bps below market pricing prices and the distribution of calls (tilted to 0.4%) and follows cumulative downside surprises of 0.5 pp between August-October. Core inflation rose by 0.2% MoM, surprising our forecast somewhat to the downside, mainly due to the goods component (0.0%), while services pressures persisted (0.4%). Core services inflation dynamics remain a watchpoint.

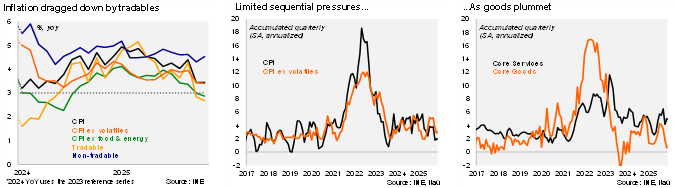

Downward pressure stems from goods. At the margin, annualized inflation accumulated over the last quarter reached 2.0%, while core inflation is at 3.0% (core goods 0.7%, core services 4.9%). Volatile inflation was broadly stable at 3.5%. Food inflation sits at 3.6% and energy inflation reached 7.4%. Excluding food and energy prices, inflation dropped by 10bps to 2.9%. Meanwhile, nominal wage data for October remained at 5.9%, well below the 8% average during late 2024 and early 2025. Despite the adjustment, real wage growth remains elevated, a factor sustaining service price pressures. Going forward, we don not anticipate significant real minimum wage adjustments.

Our Take: INE will release December CPI on January 8. Prior to today’s release we forecasted a monthly decline close to 0.1%, taking the annual print to 3.7%. Following today’s print, our yearend forecast is biased down. We forecast inflation to reach 3.0% by the end of 1Q26. Today’s print paves the way for the BCCh to deliver a 25bp cut in the December policy meeting to end the year at 4.5%. While the BCCh’s inflation forecasts are likely to be revised down in the December IPoM, core services dynamics may limit a substantial adjustment, especially considering our view for an upward revision to 2026 activity forecasts.