2025/08/06 | Andrés Pérez M., Vittorio Peretti, Andrea Tellechea & Ignacio Martínez

The Central Bank announced a reserve accumulation program of up to USD25 million daily for three years, starting on August 8, with the objective of accumulating a total of USD18.5 billion. The program will be reviewed every six months. Excess pesos from the dollar purchases will be sterilized. The statement does not mention changes to the rollover of outstanding NDFs, currently at USD2.7 billion.

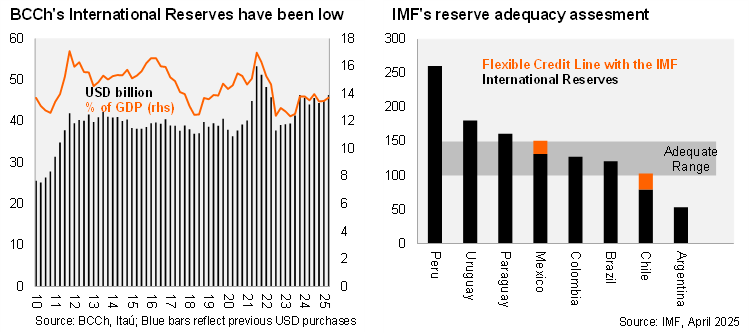

By the end of June, international reserves reached USD46.6 billion (13.8% of GDP).

The reserve accumulation program over three years would take reserves to roughly 18% of GDP, a level the BCCh has targeted in the past (also considered as an “adequate level” by the IMF). The IMF’s ARA metric estimates Chile’s reserve levels at 79% of the adequate, the lowest among free-floating inflation targetters in the region. In addition to its own reserves, the BCCh has access to the IMF’s Flexible Credit Line for USD13.8 billion, a line with the FLAR, bilateral swap lines with the NY Fed’s FIMA Repo Facility, the PBoC, and the BIS.

The program is more gradual than the June 2023 edition that targeted daily purchase of USD 40 million over a one-year period, targeting an additional USD 10 billion in reserves. Nevertheless, by October that same year, the program was suspended with a total of only USD 3.7 billion accumulated as long-term US treasury rates surged amid strong economic data, persistent inflation concerns, and expectations of prolonged monetary tightening. The CLP at the time of the previous program depreciated by around 2% following the announcement.

Our Take: The announcement was likely triggered by the mid-term review of the FCL with the IMF due month’s end. Although the daily amount seems small, the timing seems challenging considering elevated global policy uncertainty and swings in Fed repricing. The MoF may return to sell dollars again, although we estimate they are unlikely to have sufficient resources to reach the maximum weekly guidance for a sustained period (USD 300 million).