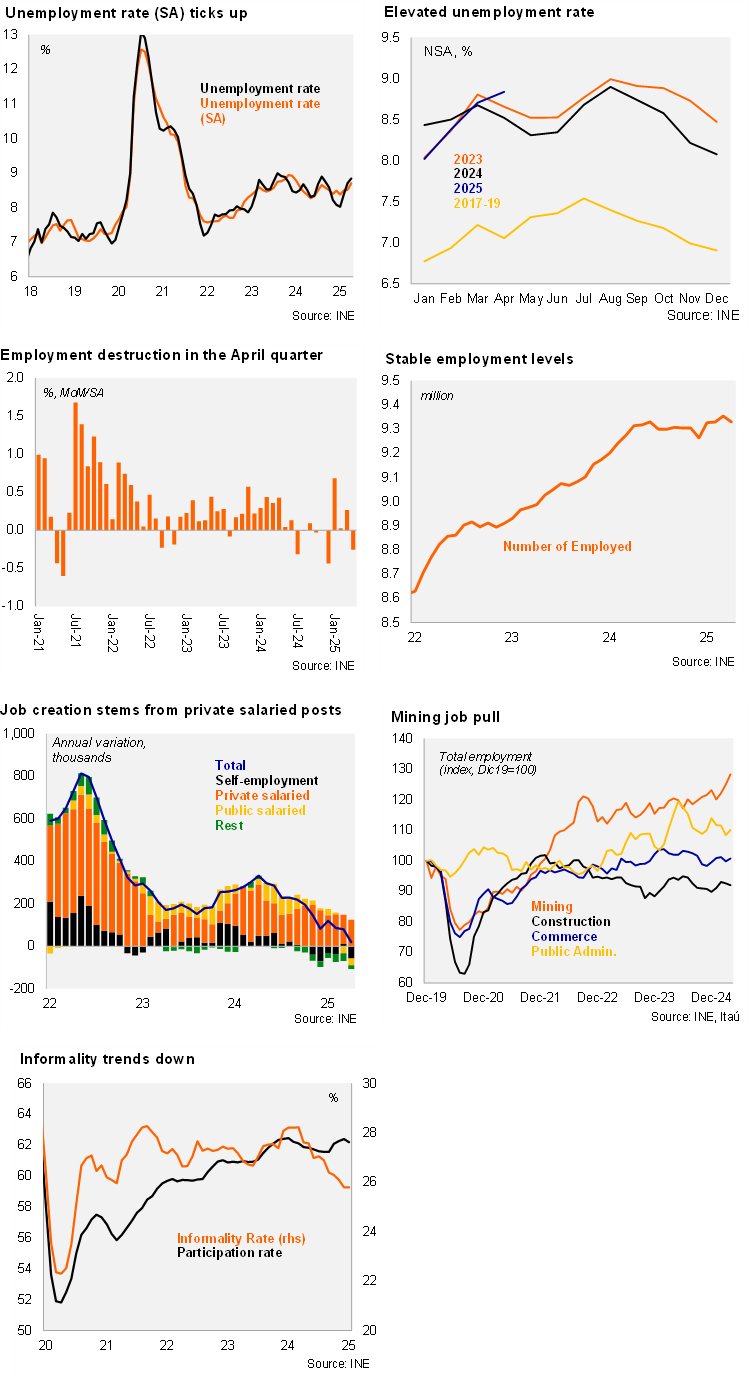

According to the INE’s labor market survey, the unemployment rate for the quarter ending in April rose to 8.8% (Bloomberg median: 8.6%; Itaú: 8.5%). The unemployment rate was 0.3pp higher over twelve months, the first annual increase since the February 2024 quarter. Employment grew by a paltry 0.2% YoY (0.9% in 1Q25), while the labor force was up by 0.6% YoY. Lower employment in construction, commerce, transportation, and public posts were key drags. Job destruction stems from informal posts, contracting by 8.2% YoY. The informality rate fell to 25.8%, down 2.4pp over one year, well below the 2018-2019 average (28.3%). Overall, the participation rate reached 62.2%, down 0.2pp from April 2024. At the margin, employment fell 0.3% (SA) from March to April. The seasonally adjusted unemployment rate reached 8.7% in the quarter, rising back to the cycle peak (Mar-24 and Sep-24). The unemployment rate (SA) has hovered around the upper bound of the BCCh’s estimated NAIRU (7-5-8.5%) for the prior several months.

Our Take: A certain degree of slack in the labor market is likely to persist in the near term. The unemployment rate has surprised consensus to the upside for three consecutive months, as net job creation has been essentially flat for several quarters. However, the economic recovery has progressed favorably in recent quarters, accompanied by positive formal job dynamics. The Government’s minimum wage bill proposes a nominal increase slightly above inflation (3.6% from May and another 1.9% in January), taking the cumulative increase this calendar year to 5.6%; we forecast CPI to end the year at 4.0%. The proposal being discussed in Congress follows the significant increases since April 2022; the minimum wage has increased by a total of 46% in nominal terms, well above the rise in CPI during the period (20%). The increase in labor costs has been highlighted by the BCCh and takes place in the context of the unemployment rate trending towards the upper bound of the NAIRU. We expect the unemployment rate to average 8.5% in 2025, in line with last year. Looking ahead, further labor market weakness, accompanied by downside inflationary pressures raise the odds of earlier rate cuts. Our baseline scenario has the BCCh resuming the easing cycle in September with a 25bp cut, yet risks tilt towards an earlier cut.