2025/08/08 | Andrés Pérez M., Vittorio Peretti, Andrea Tellechea & Ignacio Martínez

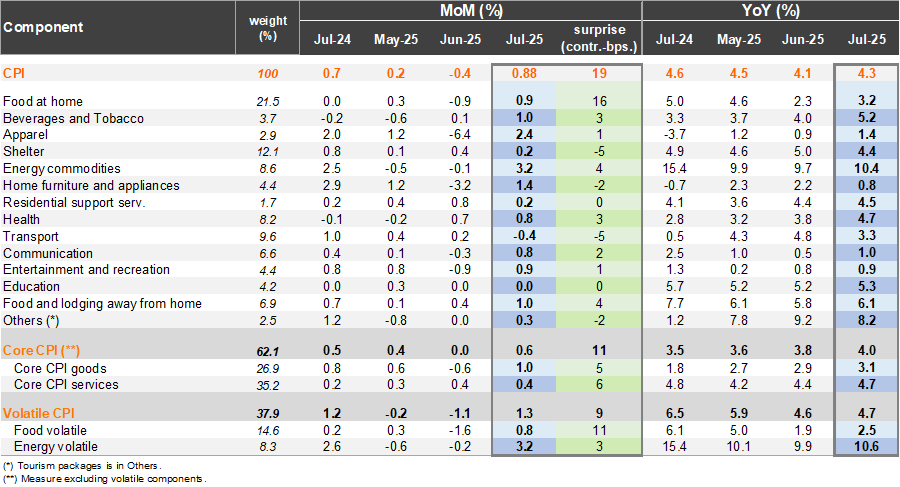

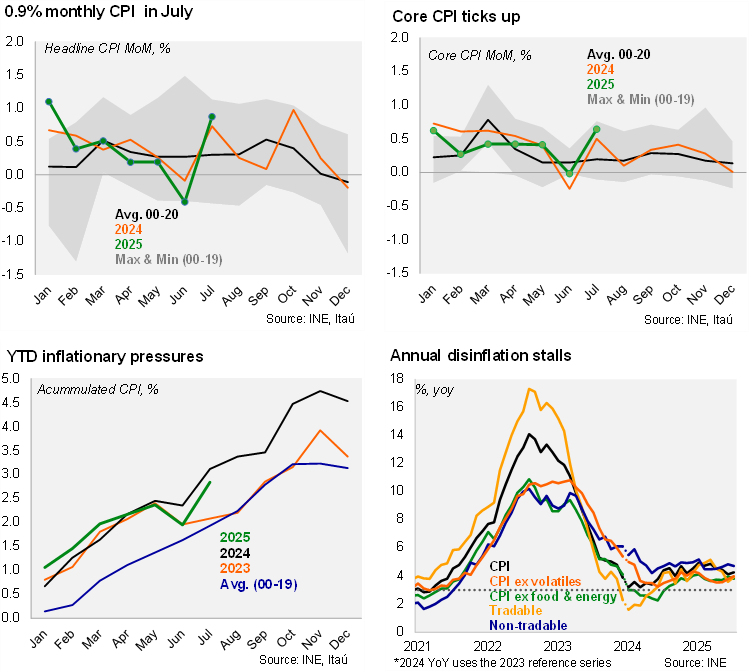

According to the INE, consumer prices rose by 0.88% from June to July, significantly above the Bloomberg market consensus of 0.6% (Itaú: 0.68%; 0.74% in July 2024). Upside pressures stemmed expectedly from the electricity prices (7.3% MoM; 24bp contribution), along with surprises in the food division (+0.9%; 19bps; lifted by red meat). The food division, telecommunications, lodgings, and dental services were key upside surprises to our call. The rebound in cyber related items such as apparel (6bps) and the household equipment and furnishings division (6bps) were broadly in line with expectations. Core inflation rose 0.6% from June (0.5% last year).

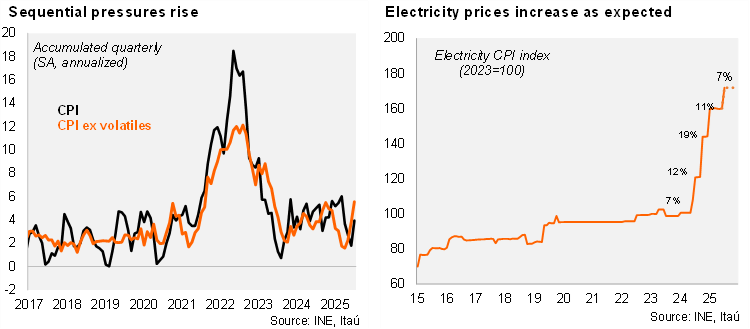

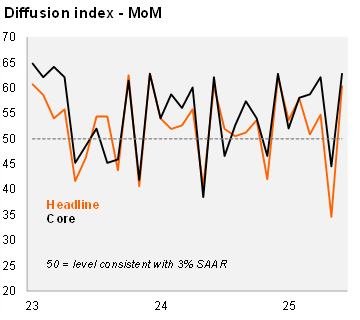

Sequential core pressures edged up. On an annual basis headline inflation increased by 4.3% (4.1% in June) and core price were up 3.9% (+0.1pp from June). Core goods inflation rose to 3.1% (2.9% in June) and core services reaching 4.7% (+0.3pp from June, highest since January 2025). Volatile inflation ticked up 0.1pp to 4.7%. Excluding food and energy prices, inflation dropped to 3.8%. Sequentially, the annualized headline inflation accumulated during the last quarter reached 4% (the highest since March this year), while core pressures shot up to 5.6% (the highest since last year).

Our Take: Consecutive upside surprises to core inflation are likely to moderate market expectations of back-to-back policy rate cuts, with pricing likely to shift cuts towards October & December. While real wage growth remains elevated it has shown signs of moderating, and labor market slack is rising. Also, manufacturing producer prices are consistent with limited upside inflation pressures. We do not expect additional electricity price adjustments to directly be measured by CPI this year, although risks of second-round effects linger. The one-year analyst survey median CPI outlook sits at 3.3%, having fallen over the last three surveys. The INE is scheduled to announce August’s inflation on September 8, we preliminarily expect an increase of 0.1%, while risks tilt to the upside for our 3.8% yearend call. We expect the monetary policy cycle to conclude with rates reaching 4% during 1H26. The timing of the next 25bp cut will depend primarily on tactical factors related to the external environment and the evolution of domestic inflation expectations.