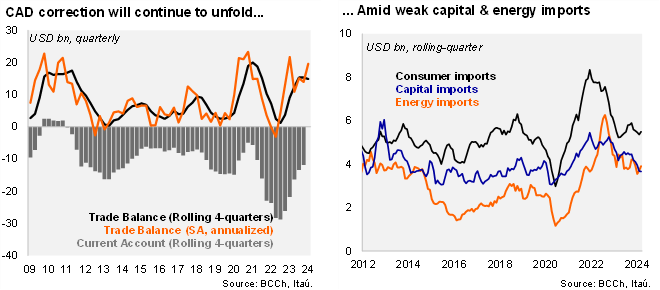

A trade surplus of USD 1.8 billion was registered in March, broadly in line with the Bloomberg market consensus, but down from the USD 2.3 billion one year earlier. The result was driven by a double digit annual decline in imports (-10%), pulled down by capital and intermediate imports (-3.7% and -21% respectively), while consumer goods rose by 9.8% YoY, printing positive for the third consecutive month in annual terms. On the other hand, total exports fell by 14% YoY, with declines across all components (Industrial: -19%; Agro: -13%; Mining -11%). The rolling one-year trade balance came at USD 14.9 billion (USD 15.3 billion In 4Q23), as the annualized quarterly trade balance sits at an elevated USD 19.6 billion (SA; USD 13.9 billion in 4Q23).

Consumer goods imports recovering, while capital goods imports remained weak in 1Q24. During 1Q24, the trade surplus was USD 5.9 billion (USD 6.4 billion in 1Q23). Total exports in the quarter fell 4.8% YoY (8.3% drop in 4Q23), dragged by manufactured exports (14.4% fall; pulled down by chemicals). Mining dropped 1.1% YoY, despite copper rising 4.2% (3.3% fall in 4Q23), as lithium exports contracted 45%. Meanwhile, total imports dropped 4% YoY (9.7% fall in 4Q23). Consumer goods imports rose 5% (10% drop in 4Q23) as the drag from durable goods imports fades while semidurable and non-durable imports accelerate. Intermediate consumer imports contracted with energy goods falling at a double digit pace. Capital goods imports dropped 12% YoY in the quarter (17% fall in 4Q23, dragged mainly due to February’s weak data), the sixth consecutive quarter of decline, reflecting the weak investment outlook.

Our take: Domestic demand imports remain weak as mildly growing consumer goods imports in the quarter are offset by a double-digit capital goods decline, reflecting the decoupling of consumption and investment dynamics in the economic recovery path. At the same time, energy imports have yet to reflect higher international oil prices at the margin. On the other hand, total exports should pick up in line with the optimistic mining performance expected for this year. Overall, we expect a manageable CAD of just below 4% this year as the recovering domestic demand is offset by a greater external impulse.