2025/09/30 | Andrés Pérez M., Vittorio Peretti, Andrea Tellechea & Ignacio Martínez

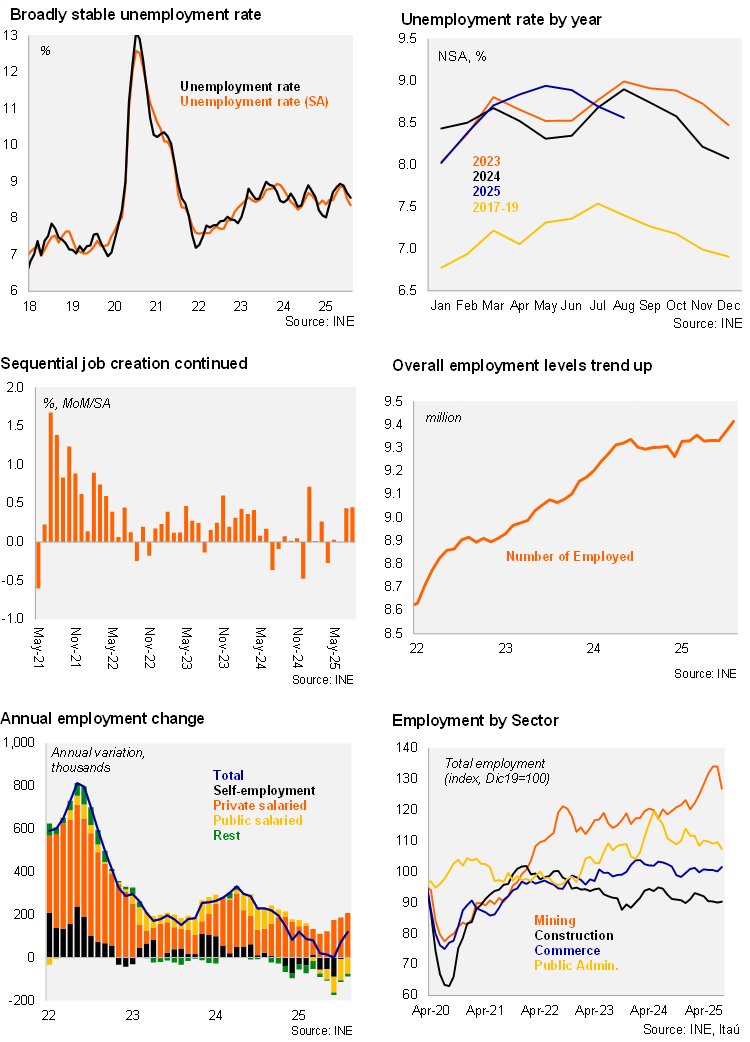

The unemployment rate reached 8.6% in the moving quarter ending in August (8.9% in the same month last year). The Bloomberg market consensus and our call was 8.7%, while our call was 8.8%. Employment rose 1.3% YoY (+120 thousand posts; 0.8% in July), while the labor force increased 0.9% (0.8% in July).On a seasonally adjusted basis (SA), employment growth was 0.4% from the July quarter (a similar growth rate to the previous month). Despite the retreat, the unemployment rate (SA) has hovered at or above the upper bound of the BCCh’s estimated NAIRU (7-5-8.5%) for more than a year. Labor market informality sits at 26%, down 0.4pp over one year. Health and manufacturing were key job creating sectors over twelve months, while construction and public administration retreated. The annual employment change continues to show an offset between positive formal job creation (+121 thousand YoY), lifted by the private sector while public posts adjust, and a gradual decline in informal posts.

Our Take: Overall data is in line with slack in the labor market, in the context of substantial increases in labor costs over the past few years, but the improving non-mining activity and signs of recovering credit demand are likely supporting a recovery of labor demand. We expect an average unemployment rate of 8.7% this year. Looking ahead, if business sentiment recovery consolidates, and the investment dynamism spills over to the construction sector amid property purchasing incentive programs and lower average interest rates, employment dynamics should improve and support a retreat into the BCCh’s NAIRU range.