2025/09/08 | Andrés Pérez M., Vittorio Peretti, Andrea Tellechea & Ignacio Martínez

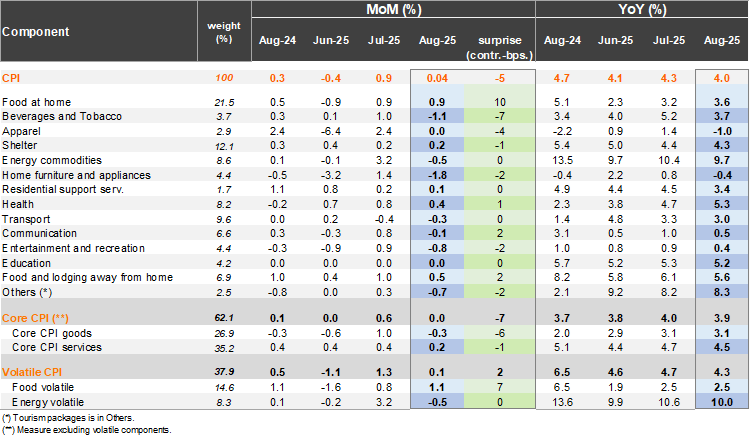

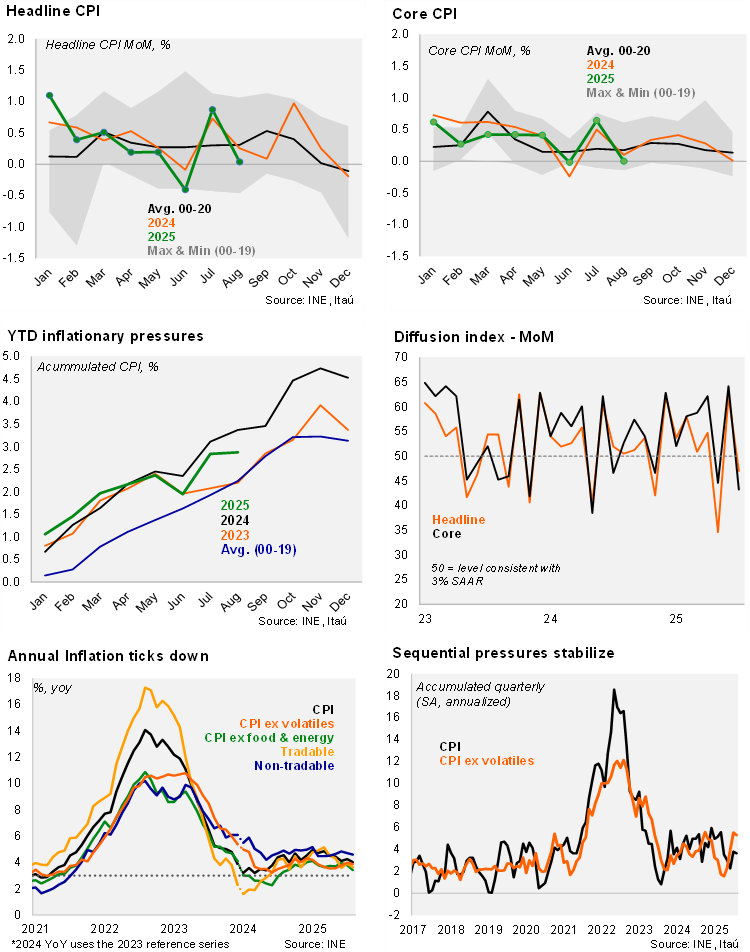

According to the INE, Consumer Price Index (CPI) in August was flat from July (0.04% MoM), below the Bloomberg market consensus (0.2%), while closer to asset prices (0.11%) and our 0.09% call. August monthly inflation last year came in at 0.26%. As a result, the annual CPI variation fell 0.23pp from July to 4.0%, the lowest since April 2024. Core CPI (ex volatiles) was also flat from July, leading to an annual print of 3.9% YoY (-0.10 pp). Items driving the monthly inflation print were beef prices (2.2%; +5bp contribution), bottled water (8.6%; +3bps), and food purchased at restaurants and cafes (0,6%; +3bps). Notable monthly drags stemmed from gasoline (-1.7%; -5bps), bread (-2.2%; -5bps) and wine (-3.9%; -4bps). The largest upside surprises relative to our nowcast came from soft drinks and bottled water, while alcoholic beverages and apparel were notable downside surprises.

Sequential core pressures stabilize. Annual core goods inflation was stable at 3.1%, while core services edged down 0.2pp to 4.5%. Volatile inflation dropped 0.4pp to 4.3%, returning to a rate last registered in September last year. Excluding food and energy prices, inflation dropped 40bps 3.4% (lowest print during the last year). Sequentially, annualized headline inflation accumulated during the last quarter reached 3.6% (20bps down from the July quarter), while core pressures ticked down 20bps to 5.3% (the highest since last year).

Our Take: The August inflation print is welcome news, following significant swings in June and July. Prior to August, core inflation had been accelerating at the margin, raising concern over the second-round effects of previous minimum wage hikes and electricity increases. We preliminarily expect a September inflation print of 0.3-0.4%, leading headline inflation to tick back up to around 4.3%. In October, base effects (linked to the 2024 electricity hike) will help see inflation fall sharply to around 3.5%. We expect a yearend print of 3.9%. The central bank’s June scenario put inflation at 3.7%. The central bank resumed cuts in July with a 25bps cut, the first of 2025, to 4.75%. With the Board at the fine-tuning stage of the cutting cycle, there is limited urgency to implement additional cuts in the near term. We expect the Board to pause this week (September 09), in line with consensus. While the August CPI print came in below market expectations, it follows two previous months of greater core price dynamics. Real wage growth dynamics remain elevated, and non-mining activity has been performing favorably, exceeding potential growth rates. As a result, we believe a gradual pace of cuts is the appropriate approach as the BCCh nears neutral, and the end of the cycle. We envision one 25bp cut in 4Q25 to end the year at 4.5%. The forward guidance is not expected to change materially, leaving the door open for further easing ahead. Asset prices and survey results show consensus for a pause.