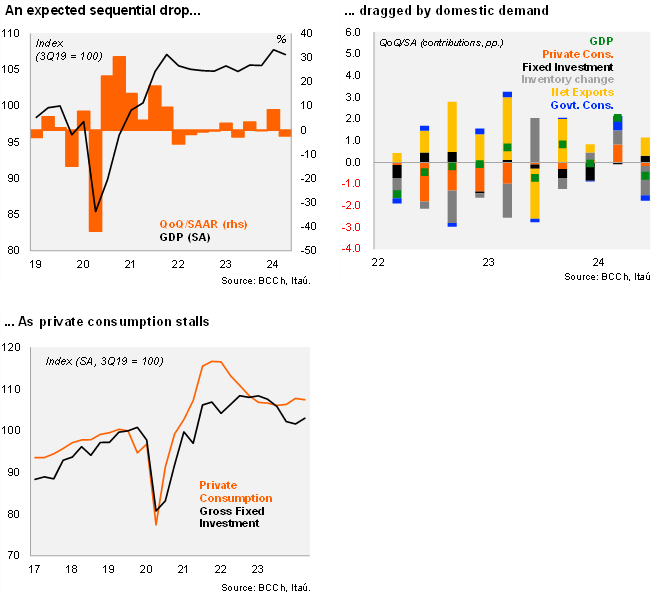

According to the BCCh's national accounts, Chile’s GDP rose by 1.6% YoY in 2Q24 (2.5% in 1Q24), in line with performance outlined by the monthly GDP proxy (Imacec). Sequentially, the economy contracted 0.6% from 1Q24 (SA), unwinding part of the strong activity start to the year. The main drags at the margin corresponded to total consumption (-0,6% QoQ/SA, -0.4 p.p. of contribution), where both the private and public components presented fell. Private consumption dropped 0.3% QoQ/SA (-0.2 p.p. of contribution; +1.4% in 1Q), while government consumption contracted -1.6% QoQ/SA (-0.2 p.p. of contribution), an expected reversion from the unsustainable spending pace seen of 1Q (+4.4%). In contrast, gross fixed investment rose by 1.4% QoQ/SA, the first positive sequential growth after four quarters, and with both components on the up. Considering the new data, if GDP remains constant at 2Q24 levels for the remainder of the year, GDP growth this year would reach 1.8%. During the 2H24, lower interest rates would likely support some momentum recovery and lead to growth of 2.5%.

Net-exports lift annual growth amid soft domestic demand and upbeat mining. Private consumption increased 0.5% YoY in 2Q24, (+1% in 4Q23), with durable goods increasing by 9.2% (the first positive number since 1Q22; -0.4% in 1Q24), but with non-durables dropping 0.6% (+0.3% in 1Q), and services increasing by 0.2% (+2% in 1Q). Government consumption increased 1.6% (+3.7% in 1Q). Gross fixed investment contracted 4.1% YoY (-6.1% in 1Q), with machinery and equipment falling 9.1% and construction down 0.7%, but with smaller contractions versus previous quarters. Exports increased 7.3% YoY, while imports decreased 2.2% YoY, resulting in a positive net export contribution (+0.8 p.p.). Subsequently, on the supply-side, activity was pulled up by mining (5.5% YoY; +0.7 p.p. of contribution), where robust copper mining was in line with the initiation of a concentrator plant and improved ore grades. Utilities (EGA, +22% YoY; +0.4 p.p. of contribution) was also a key driver, boosted by value-added in electricity generation amid great rainfalls. At the margin, activity decreased 2.5% QoQ/SAAR in 2Q24 (+8.5% in 1Q24).

Our take: The second quarter data confirmed the correction in activity momentum following the strong, and unsustainable, start to the year. Activity during 2Q came in below the BCCh’s June IPoM estimate of +2.6% YoY, reinforcing the downside risks to the activity outlook and reflecting softer demand-side inflationary pressures (as highlighted in the July MPM minutes). We expect the central bank to deliver a final cut of 25bps this year, taking the policy rate to a year-end level of 5.5%. The GDP growth range of 2.25%-3.0% is set to be lowered in the September update.