2026/01/02 | Andrés Pérez M., Vittorio Peretti, Andrea Tellechea & Ignacio Martínez

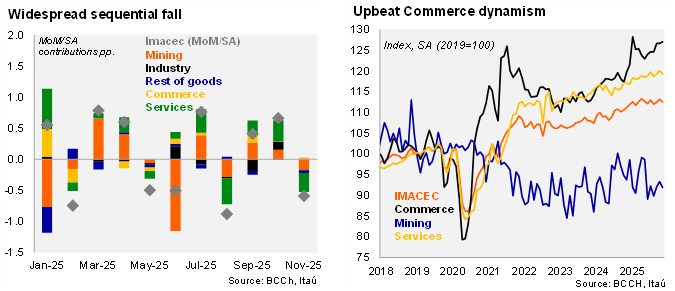

According to the BCCh, the monthly GDP proxy (IMACEC) for November rose by 1.2% YoY, below the Bloomberg median (2.2%) but closer to our call (1.6%). The print takes place on the back of recent weak sectorial data and labor market data. The annual expansion in November was the lowest since August (0.3%) and was primarily driven by persistently lower mining output (contracted annually for the past six months) and a slowdown in services. On a sequential basis, activity in November fell by 0.6% MoM SA (+0.6% in October), contracting for the first time since August, with declines across all components except for commerce (0.3% MoM SA). Services fell by 0.6% MoM SA. If activity remained flat in December, the GDP proxy would have risen by 2.2% in 2025 (NSA), slightly below our growth forecast for the year.

However, activity gained slight momentum at the margin. IMACEC data indicates that the economy expanded 2.0% YoY in the quarter ending in November (1.7% in October; 1.6% in 3Q), weighed down by a 3.1% decline in mining activity. In contrast, commerce (7.8% YoY) and services (2.6% YoY) remained resilient. On a sequential basis, overall activity grew 1.2% QoQ (SAAR), improving at the margin, but still below the strong performance of 1H25 (-0.2% in October; 3% average in 1H25). Non-mining activity posted a modest 0.3% QoQ (SAAR).

Business confidence continued its upward trend. The IMCE survey registered 45.3 in December, remaining relatively unchanged from November, while the IMCE excluding mining reached 45.9, rising 2.4 points compared to the previous month and moving closer to the neutral level of 50. Despite the downside surprise in November’s Imacec, business sentiment has continued its upward trend in recent months, in line with improving growth expectations and strong investment dynamics.

Our take: The contractions in mining output over the past six months pose headwinds to a swifter recovery looking towards next year, and contrasts with the positive sentiment associated to mining investment, amid elevated copper prices. The gradual deceleration in services demands attention and may point to the slack in the labor market, as we’ve been highlighting for several quarters. Overall, with robust non-mining activity and an improved investment outlook, we project GDP growth of 2.4% for both this year and 2026, which implies an important snapback in activity during December.