2025/10/01 | Andrés Pérez M., Vittorio Peretti, Andrea Tellechea & Ignacio Martínez

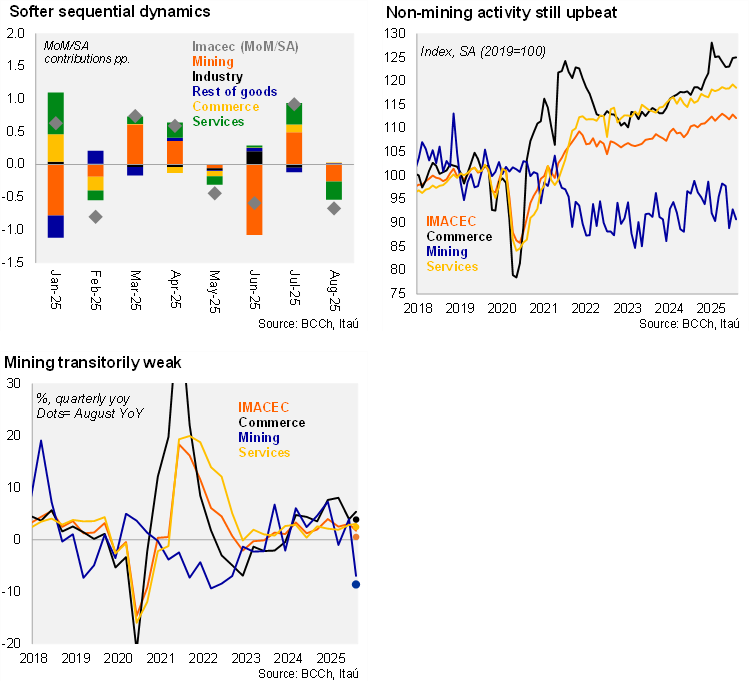

The monthly GDP proxy (Imacec) for August increased 0.5% YoY (1.8% in July), below the BCCh’s analysts survey of 1.9%, the Bloomberg market consensus of 1.7%, but closer to our 1.5% call. The bulk of the surprise versus our estimate came from weaker services. Activity contracted 0.7% MoM/SA, with mining falling 2.3% MoM/SA (-0.3 pp. contribution; in line with the closure of El Teniente operations during the first part of the month). Non-Mining activity recorded a 1.7% YoY rise (2.5% in July), in line with a sequential drop of 0.4% MoM/SA. The sequential drag to non-mining activity was led by services (-0.6% MoM/SA; -0.3 pp. of contribution), offsetting the gains in commerce (0.2% MoM/SA; mainly wholesale) and manufacturing (0.1% MoM/SA).

Recent activity momentum has been driven by non-mining activity. IMACEC data suggests the economy grew 1.8% YoY in the August quarter (3.1% in 2Q and 2.5% in 1Q25), hindered by the 7% mining drop, while commerce (5.4% YoY) and services (3.1% YoY) remain upbeat. On a sequential basis, total activity momentum came to a halt, falling by 1.2% QoQ/SAAR (the first decline since mid-2024). The pace of the mining activity unwind, amid several supply shocks, is evolving at the swiftest speed since early 2019. However, non-mining sectors grew by a swift 2.1% QoQ/SAAR (0.1% in 2Q25), sequentially pulled up by manufacturing.

Our Take: Looking through the disappointing August print. Overall, if the economy remains flat at the level of the August quarter, 2025 GDP growth would reach 2.2%. The BCCh’s implied growth estimate for 3Q25 is 2.45%, requiring a significant activity rebound in September. We preliminarily expect a September increase of around 3% YoY, consistent with growth of 1.8% during 3Q25. Business confidence levels (IMCE) during September remained near the neutral threshold (46.6 versus 50 neutral), cementing an improving trend that started in early 2023, which has gradually spilled over to greater employment demand. Furthermore, year-to-date imports of capital goods have increased by 26% YoY, with imports up 40% during the first three weeks of September, consolidating the upbeat investment outlook ahead. At the margin, there are signs that the worst of the credit slump is behind with the banking system’s stock of outstanding real loans in Chile rising annually in August for the first time since early 2024. With private sector sentiment evolving in the right direction, lower average inflation, and a mining-led investment rebound expected to buoy economic activity, we anticipate 2025 GDP growth at 2.5%, and 2.2% for 2026. We expect the BCCh to stay on hold later this month at 4.75%. We forecast September CPI, to be released on October 8, at 0.5% MoM and 4.5% YoY. Core inflation is estimated at a lower 3.9%.