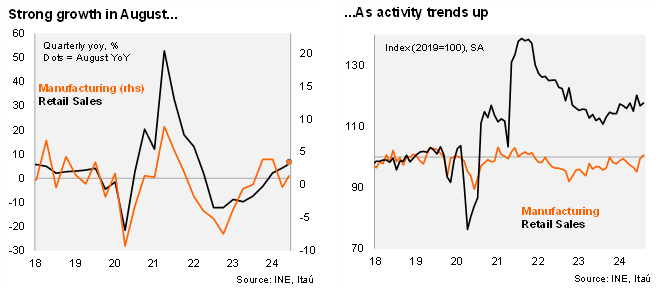

A mining rebound, a manufacturing recovery, and upbeat retail sales lifted growth in August, according to the INE’s monthly sectorial data. In fact, retail sales (including vehicles) increased 0.8% MoM/SA, leading to an annual increase of 6.8% YoY (2.8% in July), surprising on the upside for the second cconsecutive month (Bloomberg median at 4.8%, and our 5% call). Separately, manufacturing rose by 1.2% MoM/SA, leading to a 3.4% YoY increase (+5.3% in July), outperforming the Bloomberg market consensus (0.2%) and our call (-2%). Manufacturing was boosted by food processing. Mining grew a strong 8.9% (2.9% in July). As a result, industrial production (grouping manufacturing, mining, and utilities) rose 1.8% MoM/SA and 5.2% YoY (3.6% in July). The stronger sectorial data leads us to revise our IMACEC forecast up by 0.2pp to 2.8% (to be published on October 1; 4.2% in July).

Mining remains a key driver, but trends are improving across the board. Total retail sales increased by 5.9% during the quarter ending in August (4.2% in 2Q), with durable retail sales rising to 10.3% YoY (8.8% in 1Q) and non-durable goods increasing 4.8% (3.2% in 1Q). Separately, total industrial production rose 2.6% in the quarter (1.2% in 2Q). Manufacturing returned to positive territory, rising by 1.3% (-0.4% in 2Q), while mining rose 4.6% (2.6% in 2Q). In seasonally adjusted terms, mining rose a swift 13.4% QoQ/saar, retail sales increased a notable 7.2%, while manufacturing decline accelerated to 4.2% QoQ/saar (-10% in 2Q).

Our take: Activity data in Chile has been especially noisy this year, affected by several transitory shocks, but data for 3Q24 is showing favorable dynamics. Recently announced stimulus measures in China, Chile’s main trading partner, and a swift easing cycle in the US could consolidate a soft-landing scenario, contributing to a favorable impulse for the Chilean economy. We expect GDP growth of 2.5% this year and 2.1% for 2025. Anchored medium-term inflation expectations and looser global financial conditions lead us to see the BCCh continuing with a 25bp rate cuts at upcoming meetings.