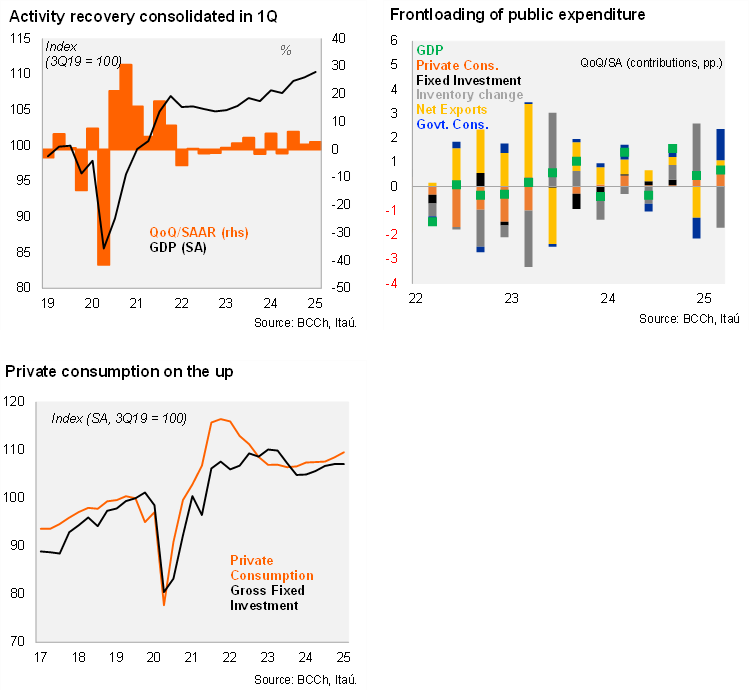

The Chilean economy grew by 2.3% YoY during the first quarter of the year, above the 2% signaled by the monthly proxy (IMACEC). Net exports (1.1pp), private consumption (1.1pp) and government consumption (+0.4pp) were the key contributors to the annual increase. Gross fixed investment posted a 1.4% YoY increase (3.3% in 4Q24), while inventories were a drag in the quarter. At the margin, the economy increased 0.7% QoQ/SA, building on the 0.5% increase during 4Q24 and the third consecutive sequential gain. Drivers at the margin stem from consumption, particularly the frontloading of government expenditure (rising 8.8% QoQ/SA), while durable private consumption rose by 1.7% QoQ/SA. Gross fixed investment was flat from 4Q24. Gross fixed investment sits at 22.7% of GDP, similar to the level of one year earlier. Considering the new data, if GDP remains constant at 4Q24 levels throughout 2025, GDP growth this year would reach 1.7% (similar to the carryover at the start of 2024).

Our Take: Overall, the 1Q25 figures consolidate an upside bias to our 2.2% call for this year. Imports of capital goods remain upbeat, private sentiment has registered only a mild dent following the swings in global trade tensions, and copper prices have remained resilient, providing optimism that the investment recovery expected this year will materialize. Above-historical real wage growth and a continued external boost from Argentinian tourism has provided a solid platform for growth this year. While we expect public expenditure to adjust as the year unfolds, risks tilt toward overall expenditure in the year above the official forecast of 2.3% real growth. The output gap is near balanced, inflation pressures are moderating, and the CLP has been well-behaved throughout the recent bouts of global risk aversion. We expect the central bank to resume its rate cutting cycle during 2H25, with risks tilting towards a cut ahead of our September call.