2025/11/03 | Andrés Pérez M., Vittorio Peretti, Andrea Tellechea & Ignacio Martínez

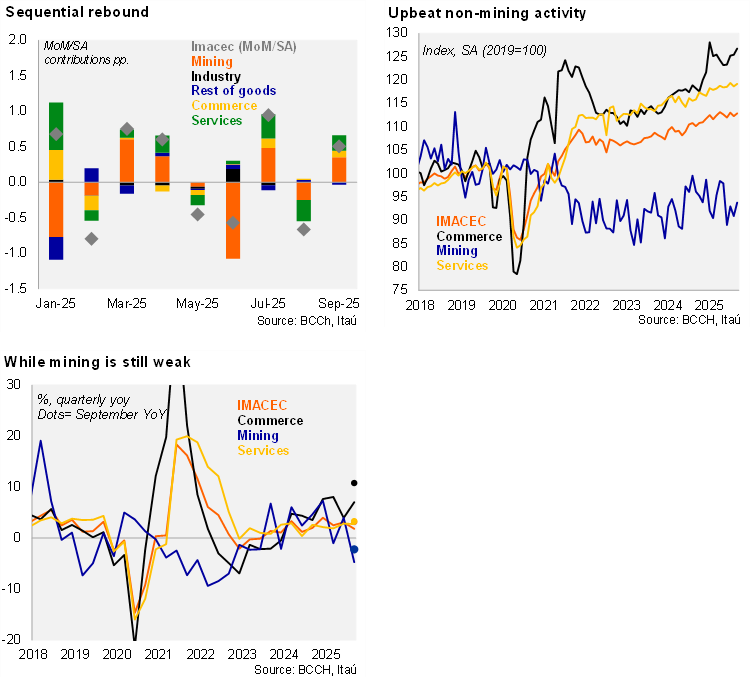

The monthly GDP proxy (Imacec) for September increased 3.2% YoY (0.5% in August), in line with the Bloomberg market consensus, and a tick above our 2.8% call. The bulk of the surprise relative to our forecast came from stronger commerce and taxes. After the economy contracted by 0.7% MoM/SA in August, activity levels rebounded with a 0.5% gain. Sequential dynamics were pulled up by a mining recovery (3.2%: +0.4pp contribution) along with the 1% commerce gain (+0.1pp) and services (0.5%; +0.2pp). Manufacturing came in weaker, resulting in an overall non-mining monthly increase of 0.2% MoM/SA.

Recent activity momentum has been driven by non-mining activity. IMACEC data suggests GDP (to be published November 18) rose by 1.8% YoY in 3Q (3.1% in 2Q and 2.5% in 1Q25), hindered by the 2.2% mining drop, while commerce (7% YoY) and services (2.8% YoY) remain upbeat. The 1.8% increase comes in below the implicit forecast of 2.5% in the 3Q IPoM, with the downside surprise likely stemming for mining supply shocks. On a sequential basis, total activity momentum slowed , increasing by 0.5% QoQ/SAAR (1.4% in 2Q). The 10.3% QoQ/SAAR mining unwind overshadowed the near potential 2.0% non-mining growth pace.

Our Take: If the economy remains flat at third quarter levels for the remainder of the year, 2025 GDP growth would reach 2.4% (SA), broadly in line with our 2.5% call (BCCh range: 2.25%-2.75%). We preliminarily expect an October increase of around 2% YoY. Business sentiment in October took a knock, dragged by a retreat in the construction sector despite signs of recovering home sales and improving credit dynamics. Non-mining business confidence sits at 41.2 (50 = neutral), the most downbeat since July last year. Meanwhile, after several months of recovery towards 2019 levels, consumer sentiment retreated on the back of less favorable expectations as well as the current economic scenario. The investment recovery story remains intact amid record high copper prices. Year-to-date imports of capital goods have increased by 25% YoY, with imports up by a similar rate during the first three weeks of October. There are consolidating signs that the worst of the credit slump is behind with the banking system’s stock of outstanding real loans in Chile rising on an annual basis for the second consecutive month to 1.0% YoY in September. With global copper prices elevated, the mining-led investment rebound is expected to buoy economic activity. Sentiment is expected to resume an improvement trend and support a spillover of more favorable activity dynamics in other sectors of the economy. We anticipate 2025 GDP growth at 2.5%, and 2.2% for 2026 with an upside bias to the latter call. We forecast October CPI, to be released on November 7, at 0.2% MoM and 3.6% YoY. Core inflation is estimated at a lower 3.5%. With activity and inflation broadly unfolding in line with the BCCh’s baseline scenario, we believe the option to cut rates at the December MPM decision will hinge on the outcome of the next two core price prints. If there are favorable signs of a swifter core price disinflation underway, the Board may be inclined to resume the cutting process. Our baseline scenario remains a yearend cut, but we also understand the rationale behind postponing the process to early 2026.