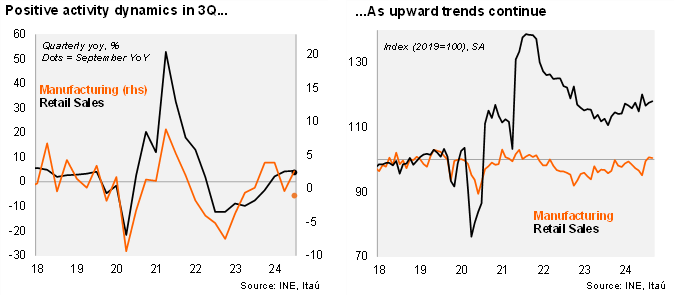

Mining led the activity recovery in 3Q, but manufacturing improved and retail posted a broadly steady, and elevated annual gain, consolidation the view of a transitory downturn in 2Q. Retail sales (including vehicles) increased 0.4% MoM/SA in September, leading to an annual increase of 3.9% YoY (6.8% in August), roughly in line with the Bloomberg market consensus (but above our 1.3% call). Separately, manufacturing ticked down 0.2% MoM/SA, leading to a 1.1% YoY decline (+3.5% in August), underwhelming the Bloomberg market consensus (+1.5%), but outperforming our call (-2.5%). Manufacturing was dragged by common metals and affected by fewer working days. The seasonally and calendar adjusted series saw manufacturing post annual growth of 4.2%. Mining grew 1.3% (8.9% in August). Overall, industrial production (grouping manufacturing, mining, and utilities) contracted 0.3% YoY (+5.3% in August; but was up +1.9% YoY/SA). Overall, the September data leads us to a 1.1% YoY forecast for the monthly GDP proxy, IMACEC (to be published on November 4; 2.3% in August), and 2.5% in 3Q24.

Activity gains momentum in 3Q. Total retail sales increased by 4.5% during the quarter (4.2% in 2Q), with durable retail sales rising to 6.6% YoY (8.8% in 2Q) and non-durable goods increasing 4.0% (3.2% in 1Q). Separately, total industrial production rose 2.9% in the quarter (1.2% in 2Q). Manufacturing growth surged to 2.6% (-0.4% in 2Q), while mining rose an elevated 4.3% (2.6% in 2Q). In seasonally adjusted terms, mining rose a swift 13.4% QoQ/saar, retail sales increased at a swift 17.4%, while manufacturing rose 17.1% QoQ/saar (-9.8% in 2Q).

Our take: Several transitory shocks and calendar effects have resulted in volatile activity data, yet 3Q data was in line with a sequential improvement as restrictive monetary policy continues to ease. We expect GDP growth of 2.5% this year and 2.1% for 2025. Anchored medium-term inflation expectations and looser global financial conditions lead us to see the BCCh continuing with 25bp rate cuts at upcoming meetings, but global developments will play a key role in domestic strategy.