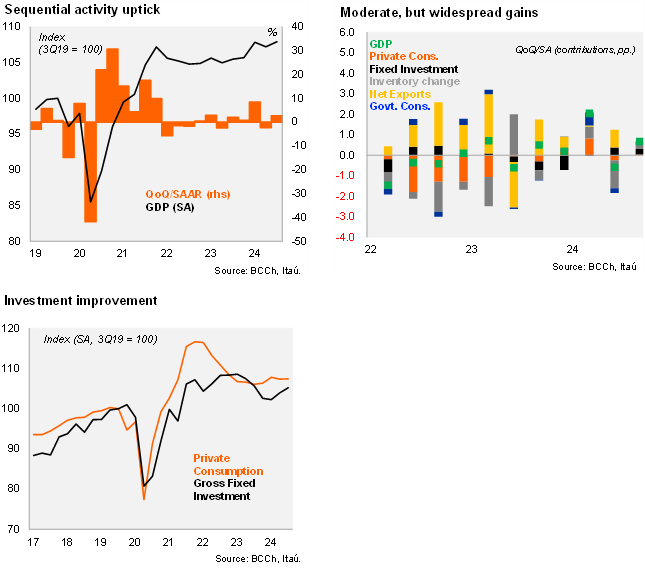

According to the BCCh's national accounts, Chile’s GDP rose by 2.3% YoY in 3Q24 (1.6% in 2Q24), a tick above the 2.2% performance outlined by the monthly GDP proxy (Imacec). Domestic demand increased a milder 0.5%, pulled up by total consumption (1.8%). Private consumption rose 1% YoY (0.7% in 2Q), lifted by durable goods. Gross fixed investment fell marginally by 0.2% YoY (-3.1% in 2Q), as machinery and equipment rose 1.2% YoY (in line with improving imports of capital goods; and the first annual increase since 2Q23). Sequentially, GDP increased by 0.7% from 2Q24 (SA), unwinding part of the decline registered in 2Q, with growth in the quarter driven by manufacturing and services. Machinery and equipment rose by 3.4% QoQ/SA, resulting in the second consecutive sequential gross fixed investment gain (+1.2% QoQ/SA). Considering the new data, if GDP remains constant at 3Q24 levels for the remainder of the year, GDP growth this year would reach 2.2%.

Net-exports lifted annual growth amid still soft domestic demand and upbeat mining. Non-durable goods sales growth picked up to 1.1% YoY in 3Q, lifted by food, pharmaceuticals, and clothing. Services growth ticked up 40bp to 0.7% YoY (lifted by transport, education and healthcare). Consumption of durable goods increased by 2.1% YoY. Despite the expectations of spending tightening during 2H24, government consumption grew by 5.3% YoY (1.2% in 2Q). Falling inventories led to a 3.8% YoY decline in total investment. Nevertheless, the contraction in gross fixed investment was far milder (-0.2%), in line with the view that the bulk of the investment adjustment has unfolded. Net exports contributed positively to activity in the quarter. Rising copper sales, along with tourism and transport linked services lifted total export growth to 6.4% (in line with 2Q). Total imports increased 1.5% YoY. Net exports contribution 1.8pp to growth in the quarter. Subsequently, on the supply-side, activity was pulled up by mining (+0.6 p.p. of contribution), and personal services (+0.9 pp). At the margin, activity increased 2.7% QoQ/SAAR in 3Q24 (-2.3% in 2Q24), as private consumption picked up.

Our Take: Data from today’s national accounts yielded no surprises, albeit in the context of activity data that has been volatile throughout the year, amid several transitory shocks and calendar effects. Lower interest rates would likely support consumption, while a less benign global environment would restrict growth dynamics during 2025. We expect the economy to grow 2.2% this year, implying flat sequential growth for 4Q24. Low carryover and a deterioration of the economy’s external impulse, support a moderate growth of 1.9% next year.