2025/08/18 | Andrés Pérez M., Vittorio Peretti, Andrea Tellechea & Ignacio Martínez

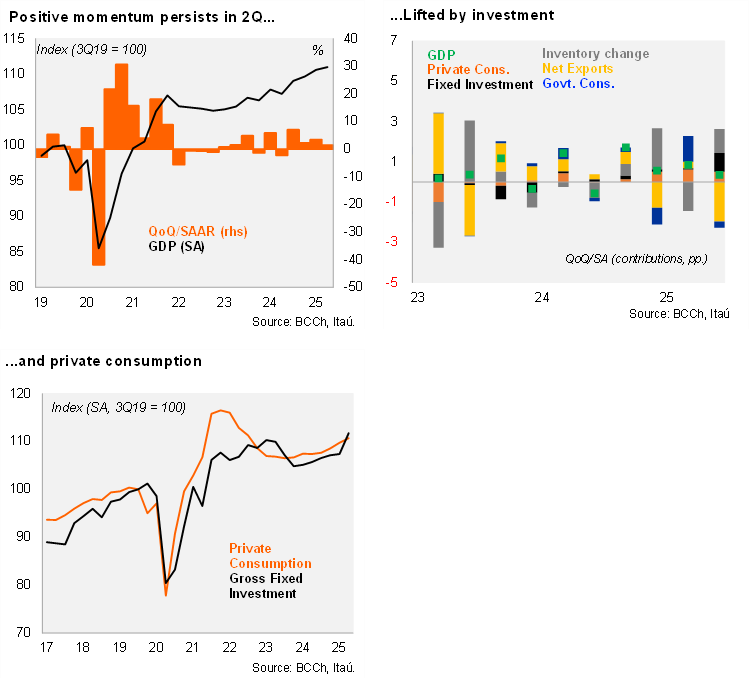

According to the Central Bank, the Chilean economy grew 3.1% YoY during 2Q25, above monthly proxy Imacec of 2.9%. Activity in 1Q25 was revised up by 0.2pp to 2.5%. During 2Q, non-mining GDP grew by 3.0% year-over-year (YoY), while the mining sector posted a 4.0% increase. The main drivers of annual growth were Private Consumption (3.1% YoY, contributing 1.84 pp) and Investment (16.2% YoY, contributing 1.28 pp). The recovery of domestic demand led to a negative contribution from Net Exports (-2.54 pp). Private consumption activity saw non-durable goods lead the way (3.4% YoY), reflecting increased spending on clothing, food, and pharmaceutical products. Services consumption rose by 2.1%, driven by expenditures on healthcare, restaurants and hotels, and transportation. Durable goods consumption surged by 7.8%, primarily due to higher purchases of technology products, especially mobile phones. Government consumption expanded by 2.6% YoY, in line with increased spending on healthcare services. Total investment rose by 16.2%, supported by both inventory accumulation and a 5.6% YoY increase in gross fixed capital formation. The latter reflects stronger investment in machinery and equipment, particularly in transportation and industrial machinery. Construction (+2%) for its part, grew in line with greater investment in engineering works.

At the margin, GDP rose by 0.4% QoQ/SA during 2Q25. Key to this result was Gross fixed capital formation (4.0% QoQ/SA), with all components contributing positively (Construction: +1.1% QoQ/SA; Machinery & Equipment: +8.7% QoQ/SA). Another key driver was Services consumption (4.8% QoQ/SA). Considering the new data, if GDP remains constant at 2Q25 levels throughout 2025, GDP growth this year would reach 2.3% (compared to the 1.4% carryover at the same point during 2024).

Our take: The 2Q25 GDP data reaffirms the economy is consolidating its recovery path. We expect GDP growth of 2.6% this year. Amid elevated copper prices, investment dynamics are improving. The Corporation of Capital Goods’ (CBC in Spanish) revised the investment pipeline up further in its 2Q25 survey. The 5-year investment forecast was revised up by 9.6% (nominal) with respect to 1Q25, reaching USD 74.1 billion, of which USD 60.3 billion are in private projects and the remaining USD 13.8 billion in public. The upward revision for the 5-year horizon was mainly explained by non-conventional renewable energy projects. The tariff exemption on copper will help sustain export demand. Meanwhile, the elevated inflow of tourists along with raised real wage growth, lower inflation and interest rates is sustaining an improvement in private consumption. Yet, despite the economic recovery, raised labor costs have seen labor market slack on the rise and could dent consumption dynamics ahead. With core inflation pressures increasing at the margin, domestic demand upbeat and the CLP under strain we expect the BCCh to progress with caution. We expect a stay-on-hold decision next month, with one 25bps rate cut to 4.5% during 4Q. The timing of further cuts depending primarily on tactical factors related to both the local and external environment.