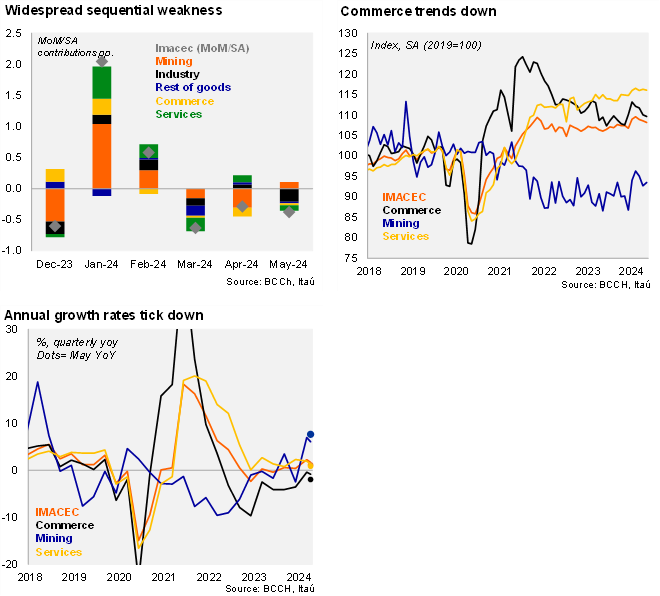

After a surprisingly strong 1Q24, activity data during the second quarter has underwhelmed. On an annual basis, the economy grew 1.1% YoY (3.5% in April), well below the Bloomberg market consensus of 2.5% and our 2.4% call (surprised by weaker manufacturing and commerce). Non-mining activity rose 0.2% YoY (3.5% previously). The month of May had one fewer working day. The annual gain was lifted by mining (7.6% YoY; 1.0pp contribution), while services rose 0.8% YoY (0.5pp). At the margin, the monthly decline of 0.4% was pulled down by manufacturing (-2.3% MoM/SA), services (-0.2%), and commerce (-0.4%). Softening activity dynamics at the margin pose a downside risk to our 2.8% growth call for the year.

During the quarter ending in May, non-mining activity fell sequentially. The headline IMACEC increased 1.7% YoY in the quarter (2.3% in 1Q24), with non-mining up a milder 0.9% (1.5% in 1Q). Services growth ticked down 0.6pp to 1.3%, while commerce continued to contract. Mining remained a key pull, rising 6.1% YoY (7% in 1Q). At the margin, the 0.4% qoq/saar increase was primarily due to mining (6.2%), with non-mining activity falling 0.5% qoq/saar (+4.5% in 1Q24; the first reversion since the August 2023 quarter). Softening services (1.2% from 4.6% in 1Q) and manufacturing (0.8% from 4.2% in 1Q), along with contracting commerce were behind the weaker activity data.

Several indicators support weaker activity dynamics. Commercial loans in May contracted again (-3.4% real year-on-year), while imports of capital goods during the first three weeks of June contracted 26% YoY, suggesting weak short-term investment prospects. In parallel, business confidence, measured by the IMCE, fell to 43.78 in June, below the maximum reached in March of this year (46.31), remaining below neutral (50) since February 2022.

Our take: May’s IMACEC print, put together with the recent months, points to a certain loss in momentum of economic activity after a particularly strong start to the year. Holding activity constant at May levels would lead to a growth of 1.4% this year, down from the 2.4% using end-February levels. Monthly activity data in Chile has been unusually noisy recently, maybe due to the swings in working days and seasonal factors. The intense rainfalls of June are likely to boost electricity output (measured in value added terms) in the month, yet the related suspension of classes in certain regions should weigh on activity. We expect the economy to grow 2.8% this year, but with a downward bias. In this context, we expect the central bank to continue lowering the monetary policy rate on July 31, by 25bps to 5.5% and then pause when reaching 5.25% in September.