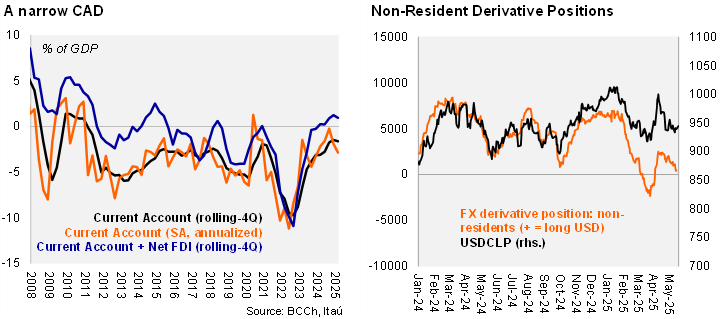

A USD 0.6 billion surplus was registered at the start of the year (Bloomberg: USD 0.8 billion; Itaú: USD 0.2 billion call), smaller than the USD 1.2 billion surplus in 1Q24. The surplus was equivalent to 0.7% of GDP, while the rolling-4Q current account balance came in at a moderate deficit of 1.6% (1.5% in 2024). The surplus was driven by a large trade surplus of goods (USD 6.9 billion), with exports rising by 6% YoY, and the gradual domestic demand recovery leading to an import improvement (8.4% YoY). Part of the surplus was offset by a growing income deficit (USD 4.6 billion) as high copper prices boost FDI investment results. The annual CAD is comfortably financed by FDI. Net foreign direct investment into Chile (around 2% of GDP) comfortably financed the 1.6% CAD.

Our Take: The low CAD reflects a well-balanced economy, likely supporting a more favorable external view of the CLP, despite narrow interest rate differentials with the US leading to lower FX volatility compared to previous episodes of global market stress. We expect some widening of the CAD this year to around 2% as domestic demand improves and the global export pull moderates.