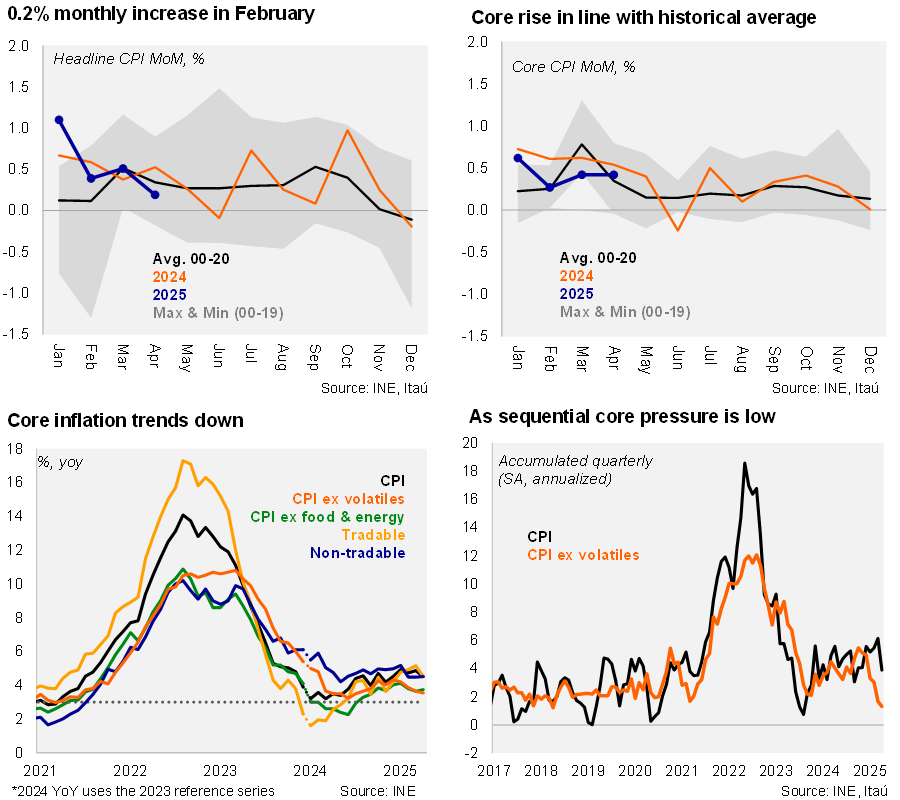

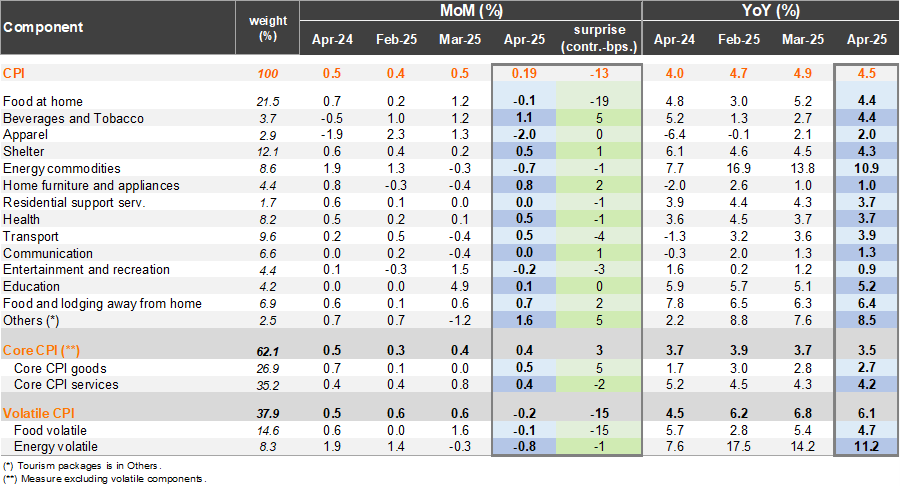

According to the INE, consumer prices increased by 0.2% from March to April, below both the Bloomberg market consensus and our forecast of 0.3%. The price increase was driven by the diverse goods and services division (up 1.2% MoM, contributing 4 bps, lifted by personal care products) and the housing and basic services division (contributing 4 bps, lifted by rent). Downside pressures came from the apparel division, which was in line with expectations. The transportation division also posted a mild decline, led by the anticipated gasoline price drop of 1.2% MoM (a reduction of 3.5 bps). The surprise relative to our forecast came from the food and beverage division, particularly due to volatile items. Core prices, excluding volatile items, increased by 0.4% from March, in line with expectations. Overall, second-round effects from the previous electricity adjustments remain contained.

The disinflation process is consolidating, with core inflation nearing the target. In annual terms, headline inflation dropped by 40 bps to 4.5%. Annual inflation has been above the 3% target since early 2021. Core inflation ticked down by 20 bps to 3.5%, the lowest rate since July last year. Core goods inflation dropped by 10 bps to 2.7% year-over-year, as did core services to 4.2%. Volatile inflation fell by 70 bps to a still-elevated 6.1%. Excluding food and energy prices, inflation sits at 3.7%. Sequentially, the annualized headline inflation accumulated over the last quarter reached 3.9% (the lowest since 3Q24), while core pressures came in at a low 1.3%, down from a recent peak of 5.5% in the October 2024 quarter.

Our Take: The downward surprise in April follows several months of data aligning with market projections. Beyond this one-off surprise, the recent dynamics suggest that fears of further inflationary persistence, due to potential second-round effects and other factors, appear to be easing. We preliminarily expect an inflation rate of 0.2-0.3% for May. Looking ahead, an anticipated 7% increase in electricity prices in July may slow the disinflation process, before a pronounced decline towards the end of the year due to base effects and lower global oil prices. We forecast year-end inflation at 4% (BCCh: 3.8%). We expect that as the pace of inflation decline accelerates during the second half of 2025, and the global economy shows signs of slowing, the central bank will resume cutting rates (2x25bps to 4.5%). The INE is scheduled to announce May's inflation on June 6.