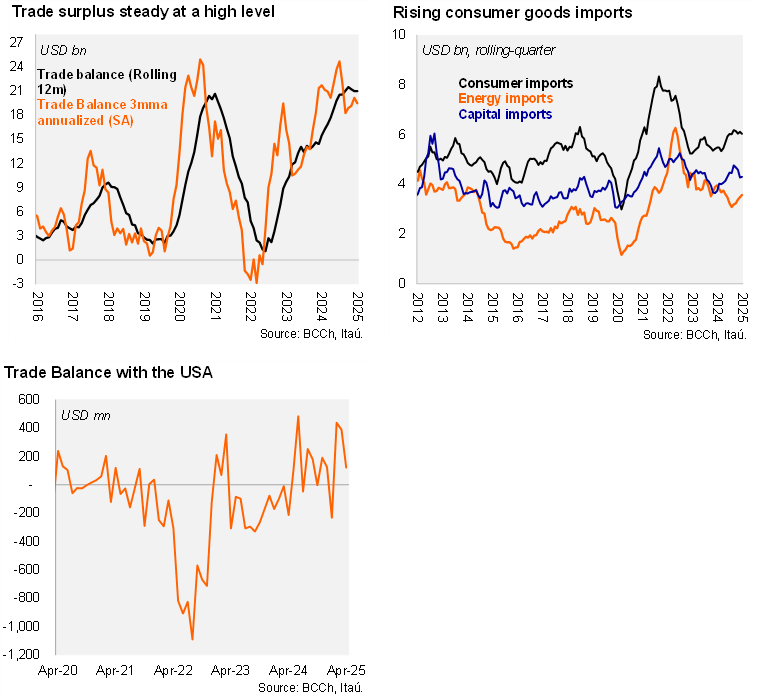

April’s goods trade surplus came in line with our estimate (Bloomberg consensus: USD 1.8 billion). Nominal mining exports reached the highest value since March 2023. Copper exports increased 8.2% YoY (8.8% in 1Q25). Lithium exports fell by 38%, continuing to adjust from the 2022 boom amid falling prices. Agricultural and fishing exports dropped 11.3% YoY (-3.4% in March). On the manufacturing front (+8.6% YoY), food processing was a key driver (up 20%), while chemical and paper exports ticked up. Imports continue to reflect improving domestic demand with consumer and capital goods at elevated levels. Meanwhile, low global oil prices are sustaining a decline in the import value of energy goods. Total imports rose 7.3% YoY (8.3% in 1Q25). Capital goods increased 11.8%, sustaining a double-digit growth pace since early 4Q24. Imports of machinery for mining and construction more than doubled over twelve months (a favorable development for investment dynamics). Consumer goods imports increased 5.7% YoY (12.5% in 1Q25), lifted by apparel, while durable goods imports rose 4.9%. Energy imports fell by 2.5% YoY, dragged down by diesel (-12%).

The rolling 12-month balance in April reached an elevated USD 21 billion (near 7% of GDP). The annualized quarterly trade balance sits at USD 19.5 billion (SA), edging down from the cycle peak of near USD 25 billion during the October quarter. During the April quarter, exports increased 3.9% YoY (5.9% in 1Q25), and a milder 1.6% sequentially (QoQ/SA, annualized; -6% in 4Q24). Total imports rose 7.9% in 1Q25 (8.3% in 1Q25) but dropped 0.9% at the margin (QoQ/SA, annualized; 21.5% in 4Q24).

Our Take: The expected global activity slowdown will likely dent exports demand and gradually diminish the elevated trade surplus. We expect a CAD of 2% of GDP this year (-1.5% last year). Chile’s YTD goods exports to the US account for roughly 17% of total exports, up from 11% during the same period in 2024, likely suggesting frontloading of goods prior to the implementation of tariffs. The import share from the US has been broadly stable at 20%. As a result, the YTD trade balance sits at a USD 0.7 billion surplus with the USA (USD 0.5 billion deficit during the corresponding period last year).