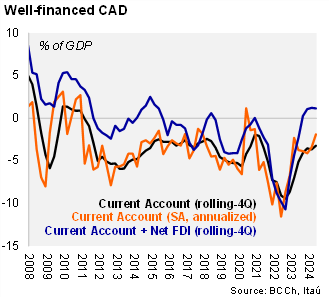

The current account balance in 2Q24 came in at a deficit of USD 1.8 billion (2.3% of GDP), in line with the Bloomberg market consensus and our call. The deficit was below the USD 3.5 billion deficit of 2Q23 (but larger than the small surplus in 1Q24), resulting in the rolling-4Q CAD falling to 3.1% of GDP (from 3.6%). The narrow CAD in the quarter was supported by a large USD 5.7 billion trade surplus for goods (USD 3.3 billion one year earlier). On the other hand, the income deficit rose to USD 5.3 billion (USD 4.2 billion in 2Q23), as elevated copper prices likely favored FDI investments. The CAD was favorably financed, with net FDI coming in at USD 3.6 billion, exceeding the USD 1.8 billion CAD. External debt fell to 79% of GDP, down from 83% in 1Q24. Overall, the normalization of domestic demand has contributed to a sustainable balance of payments scenario.

Copper exports supported a large trade surplus for goods. Exports of goods increased 6.6% yoy (1.3% fall in 1Q24) in 2Q24. Copper exports rebounded, boosted by both prices (16% yoy), and volumes (5.1% yoy). Imports of goods fell 5.1% yoy, as all divisions posted declines. Consumer goods imports dropped 1.5% YoY (after a 4% increase in 1Q), amid both moderate declines both prices and volumes. A double-digit contraction in the volume of capital goods led to and overall drop 12.4% YoY (broadly in line with 1Q). The services trade deficit narrowed by USD 0.4 billion over one year amid an 18% rise in exports (primarily due to inbound tourism). The rolling-4Q income deficit continued to tick up to USD 19.1 billion (USD 17 billion last year; USD 14.2 billion in 2022), lifted by the return of FDI in Chile.

FDI dynamics bolster favorable financing mix. The USD 4.5 billion of direct investment into Chile was led by profit reinvestments, loans and capital injections. The rolling-4Q net FDI reached USD 14.2 billion (4.4% of GDP), exceeding the comparable CAD of USD 10.5 billion (3.1% of GDP). In the quarter, portfolio investment registered a net outflow of USD 3.4 billion, led by pension fund investments in equity.

Our take: Soft domestic demand (particularly related to investment) and sustained export growth have supported a large trade surplus scenario. We expect the CAD to come in at a smaller 2.7% of GDP this year (vs. 3.6% in 2023). While short-term inflation pressures are tilted to the upside, they are supply-side derived. The soft domestic demand scenario, still tight loan conditions and a stagnating labor market are in line with the central bank’s view of lower rates over their two-year forecast horizon. A narrow CAD provides additional buffer in the process of lowering rates. We expect the policy rate to end the year at 5.50%, 25bps lower than the current level.