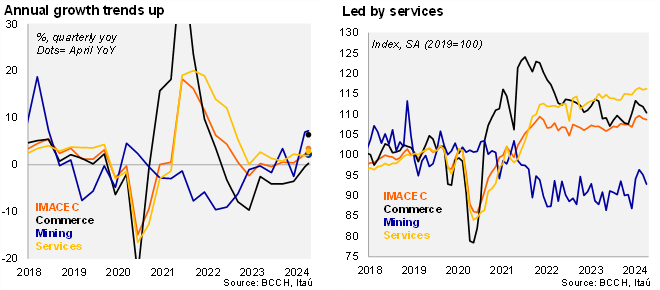

The monthly GDP proxy (IMACEC) fell 0.2% from March to April (SA), building on the prior 0.6% drop, pulled down by mining and commerce. On an annual basis, the economy grew 3.5% YoY (0.5% in March), in line with the Bloomberg market consensus of 3.5% and our 3.4% call. Non-mining activity also rose 3.5% YoY. The annual gain was lifted by services (+1.4pp contribution; pulled up by personal services and transportation). Higher annual growth with respect to March’s 0.5% was in part due to the three additional working days compared to 2023. Adjusting for seasonal and calendar effects, annual growth was 2.1% (1.8% in March) while non-mining activity also rose 2.1% YoY (0.9% in March). At the margin, the monthly decline of 0.2% was pulled down by mining (-2.4% MoM/SA) and commerce (-1.4%), while services and manufacturing posted moderate gains. Nevertheless, during the rolling quarter, the economy increased at a swift 5% QoQ/SAAR pace (7.5% in 1Q24; 0.3% in 4Q23).

During the quarter ending in April, non-mining activity advanced. The headline IMACEC increased 2.6% YoY in the quarter (2.3% in 1Q24), with non-mining up 1.9% (1.5% in 1Q). Services growth ticked up 0.1pp to 2.0%, while mining jumped to 7.3% (7% fall in 1Q) and the drag from commerce diminished (+0.3% from -0.4% in 1Q). At the margin, the 5% qoq/saar increase was primarily due to mining (20%), with non-mining activity rising 2.8% qoq/saar (4.5% in 1Q24). Service growth pace slowed from 4.4% in 1Q24 to a still upbeat 3.6% qoq/saar.

Leading indicators suggest an activity improvement. Think-tank ICARE’s business sentiment in May resumed an upward trajectory. After a sentiment drop in April put an end to a three month recovery path, business confidence picked up 1.2pp to 45.3 points (50 = neutral), with the non-mining index at 40.9 (39.3 in April) and the construction sub-index rising 4.3pp to a still-low 26.9 points. Imports of consumer goods are consolidating a return to growth during the first third of the year, while the outlook for investment (through capital goods imports) is less upbeat. Credit dynamics appear consistent with our outlook for the economy, with consumer loans improving, in line with a private consumption-led recovery, and commercial loans still weak, suggesting investment is likely to remain subdued this year.

Our take: We expect lower average inflation, falling interest rates, and a positive external backdrop to support the recovery of economic activity this year. We have an upside bias to our 2.4% GDP call for 2024. Recovering mining will also play a key role behind the improvement from the 0.2% last year. With the output gap near closed and medium-term inflation expectations anchored to the 3% target, the central bank will continue to cut its policy rate. Today’s traders survey showed the expectation to further lower the pace to 25bp later this month and continue at that pace ahead until reaching 5% by yearend. We hold a similar view (25bp cuts to 5.25%), but note that a low May CPI print along with well-behaved CLP dynamics leading up to the June meeting may tempt the central bank to continue with the 50bp pace (although recently the Board has made a concerted effort to avoid surprising the market).