The monthly GDP proxy (IMACEC) fell 0.7% from February to March (SA), with a widespread partial unwinding of strong growth dynamics at the start of the year. On an annual basis, the economy grew 0.8% YoY, below the Bloomberg market consensus of 1.1% and our 0.9% call, while broadly in line with the central bank’s estimate (implied from the 1Q24 IPoM). Non-mining activity fell 0.4% YoY. The annual gain was lifted by mining and electricity generation. The grow deceleration from 4.5% in February (boosted by the leap-year effect) was in part led by three fewer working days (due to Easter). Adjusting for seasonal and calendar effects, annual growth was 2.1% (2.8% in February) while non-mining activity rose 1.3% YoY (2% in February). At the margin, the monthly decline of 0.7% was pulled down by goods (-1.4% MoM/SA) and services (-0.4%). Nevertheless, during 1Q24, the economy increased at a swift 8.4% QoQ/SAAR pace (0.4% in 4Q23). We expect the BCCh to continue to cut rates ahead but to further reduce the pace given upside inflation pressures stemming from CLP passthrough along with expected regulated price adjustments and the fact that the cycle is nearing Fed levels.

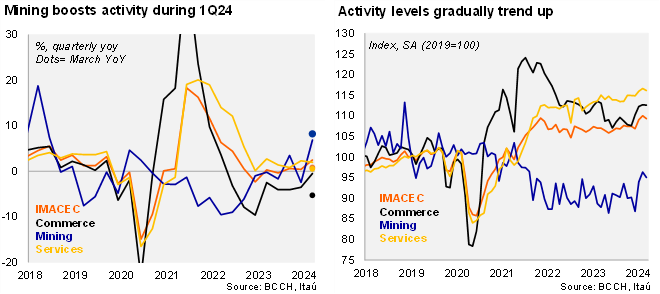

During the first quarter of 2024, non-mining activity advanced. The headline IMACEC increased 2.5% YoY in the quarter (0.4% in 4Q23), with non-mining up 1.8% (0.8% in 4Q). Services growth eased 0.3pp to 2.0%, but mining jumped to 6.9% (2.5% fall in 4Q23) and the drag from commerce diminished 3pp to a 0.5% drop. At the margin, the 8.4 % qoq/saar acceleration was primarily due to mining (30%), but non-mining activity also improved (from 2.3% to 5.6% qoq/saar). Broadly steady service growth near 5% was supported by recovering commerce and manufacturing activity.

Leading indicators suggest an activity recovery this year but investment should likely remain a drag. Think-tank ICARE’s business sentiment in April dipped, putting an end to a three month recovery path. Business confidence sits at 44.1 points (50 = neutral; 46.3 in March), with the non-mining index at 39.3 (42.2 in March) and the construction sub-index remaining weak (22.7). Imports of consumer goods rose in 1Q (+5% YoY; but capital goods imports continue to fall at a double-digit pace). Real bank credit’s annual growth remained slightly positive in 1Q24, while upbeat sequential employment growth and rising wages have led to an improving real wage bill. On the other hand, the front-loading of fiscal expenditure slowed in March and an expected adjustment for the remainder is expected.

Our take: If activity remains at the 1Q24 level for the remainder of the year, the economy would grow by 2.3%. We expect the monthly GDP proxy to snap back in April, supported by a reversion of the calendar effects that weighed on activity in March. Overall, the economic recovery remains on track from the 0.2% posted last year, lifted by improvements in private consumption, while mining rebounds after recent operational challenges. Activity data will be revised along with the publication of the national accounts on May 20. We expect GDP growth of 2.4% this year.