2026/02/09 | Andrés Pérez M., Vittorio Peretti, Andrea Tellechea & Ignacio Martínez

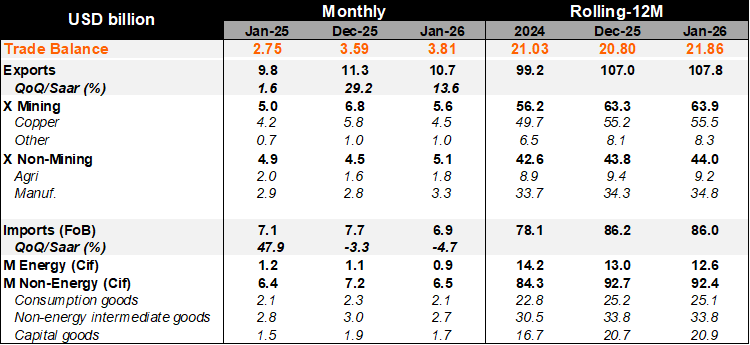

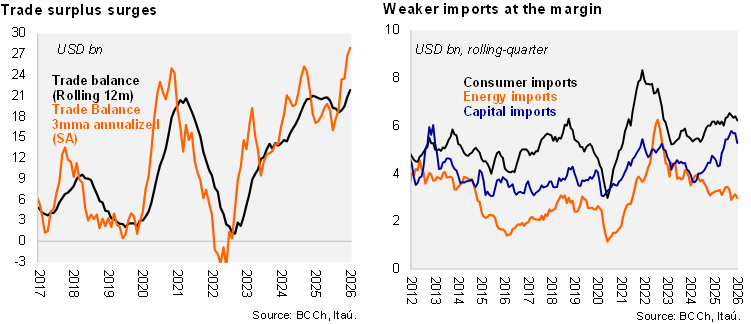

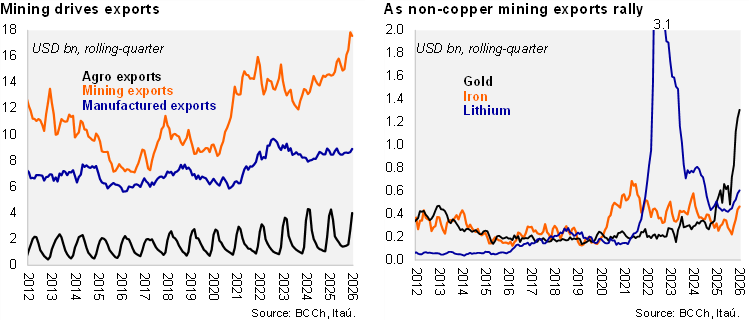

A trade surplus of USD 3.8 billion was recorded in January (Itaú: USD 4.2 billion), lifted by mining and manufacturing while imports softened. As a result, the rolling 12-month trade balance reached USD 21.6 billion (USD 20.8 in 2025; USD 21 billion in 2024). The annualized quarterly trade balance sits at a higher USD 28 billion as mining exports rebound. Exports grew 8.5% year-on-year in January (18.7% in December), boosted by the 12.1% mining gain. Within mining, copper exports rose by 7.9%, meanwhile gold exports increased 33% (USD 389 million), and lithium exports jumped 28% (USD 248 million). Manufactured exports were up 13.9% (lifted by food and chemicals), unwinding weaker dynamics registered in 4Q25. Exports of cherries fell 20% at the start of the year amid overall agriculture softness. On the import side, total imports contracted by 3.1% YoY (6.6% in December) with consumer goods falling by a similar rate. Imports of durable consumer goods slowed (led by computers), and foods imports declined. Energy imports fell 28% YoY amid low global oil and gas prices. On the other hand, capital goods increased 11.4% (7.7% in December), lifted by transportation vehicles while machinery and cargo vehicles declined.

Our Take: Elevated terms-of-trade are projected to sustain another large trade surplus in 2026 (USD 22 billion), offsetting the gradual recovery of domestic demand resulting in CAD of 2.2% (2.5% estimated for 2025). The small CAD will likely remain financed by FDI, given the improving growth outlook for the economy, reflected by positive business sentiment. We expect GDP growth of 2.6% this year.