2025/10/08 | Andrés Pérez M., Vittorio Peretti, Andrea Tellechea & Ignacio Martínez

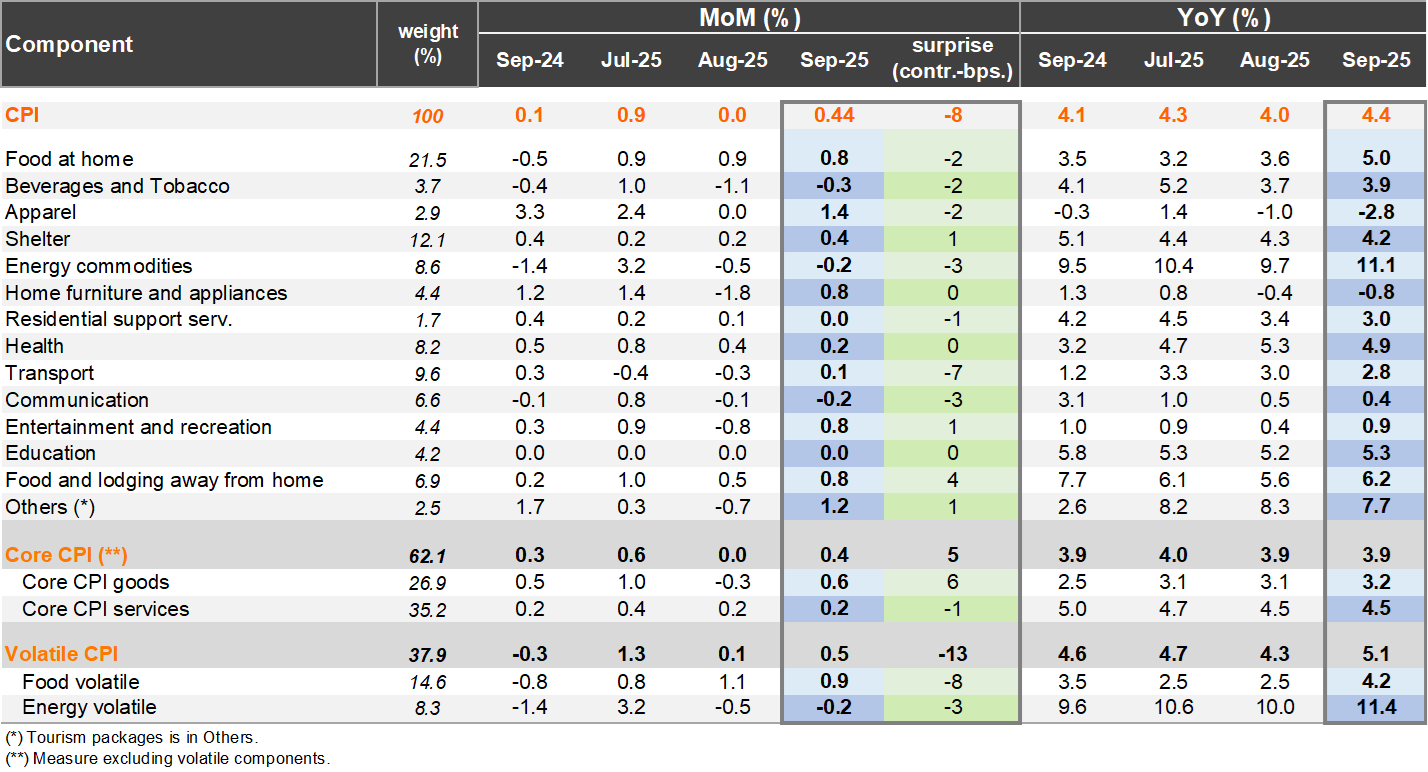

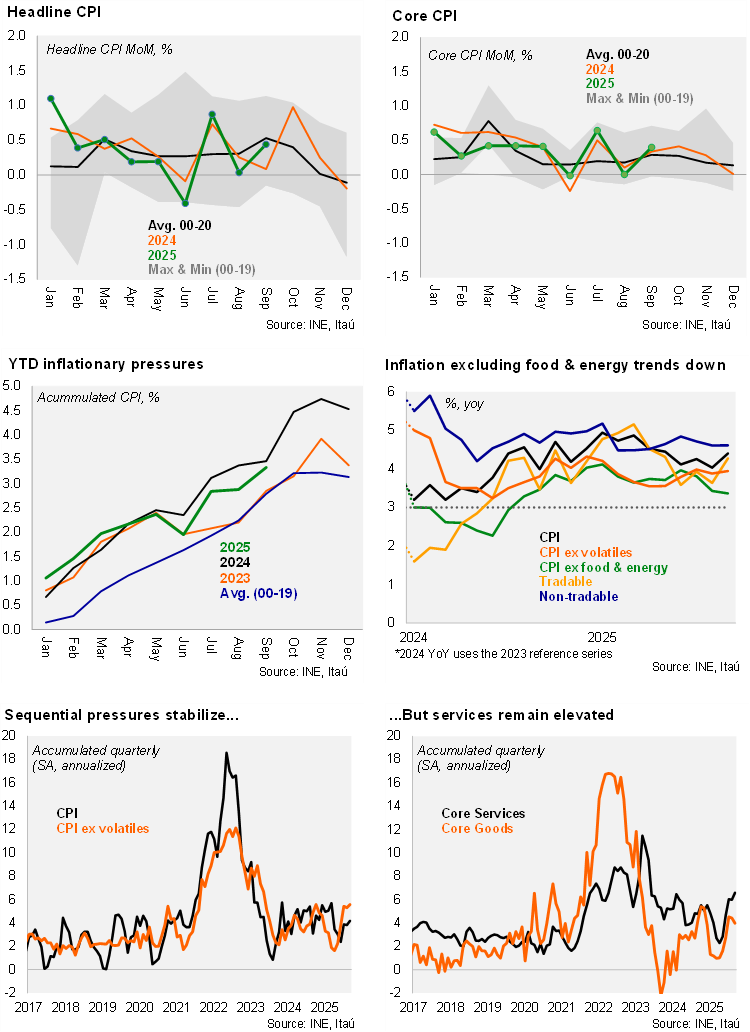

According to the INE, Consumer Price Index (CPI) in September rose by 0.44% from August, in line with the Bloomberg market consensus (0.4%) and asset prices (0.44%), while below our 0.53% call. In 2024, September monthly’s CPI came in at a low 0.09%, leading this year’s annual print to rise from 4.0% in August to 4.4%. Headline inflation averaged 4.23% in 3Q, somewhat below the IPoM baseline scenario of 4.27%. Core CPI (ex-volatiles) rose by 0.40% from August, leading to 3.9% YoY. Core inflation averaged 3.93% in 3Q, also below the IPoM baseline scenario of 4.01%. Driving the monthly inflation print were food items (tomatoes, bread), with the division increasing 0.8% MoM (+0.2pp contribution), along with interurban transportation (12.8% MoM; +3bps). The largest downside surprises relative to our nowcast came from beef, international air travel, gasoline, and new vehicles.

Sequential core services pressures remain elevated. Annual core goods inflation was stable at 3.9%, with core services steady at 4.5%. Volatile inflation rose 0.8pp to 5.1%, explaining all the increase in the headline inflation print. Excluding food and energy prices, inflation remained at 3.4%. Sequentially, annualized headline inflation accumulated during the last quarter reached 4.2% (above the 2.4% in the June quarter), while core pressures ticked up to 5.6% (the highest since late last year; 3.8% in June). Within core, services sits at an elevated 6.6%. While core pressures are elevated, there are some signs of moderation with services posting a consecutive 0.2% MoM gain, while real wage data for August also showed a gradual sequential slowdown. One of the main sources of recent concern has been the extent of passthrough from higher wages to inflation dynamics.

Our Take: The downside surprise in 3Q25 relative to the BCCh’s implicit inflation forecast is not enough to warrant a cut in the policy meeting later this month (28th). Nevertheless, the Board is likely to discuss both maintaining and cutting 25bps, opening the door for a December cut if sequential core price pressures moderate. By December, the Board will have two additional inflation prints to consider. Our preliminary forecast for October is between 0.2-0.3% MoM, leading to an annual decline to roughly 3.7%. This print will be released on November 7. Our yearend call is 3.9%.