2025/09/17 | Diego Ciongo & Soledad Castagna

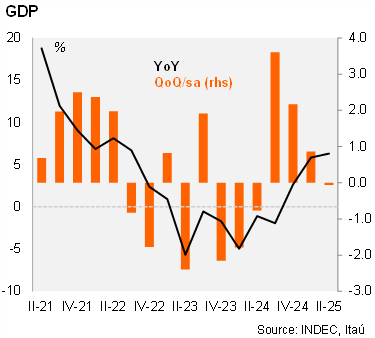

GDP rose by 6.3% yoy in 2Q25, up from 5.8% in 1Q25. At the margin, using the INDEC seasonally adjusted series, GDP fell by 0.1% qoq/sa in 2Q25, which is slightly worse than the 0.0% anticipated by the monthly GDP proxy EMAE. Furthermore, the INDEC adjusted past data. In 1Q25, the GDP grew by 0.9% qoq/sa, instead of 0.8% qoq/sa published in the previous report. Thus, the statistical carryover for 2025 stands at 4.0%.

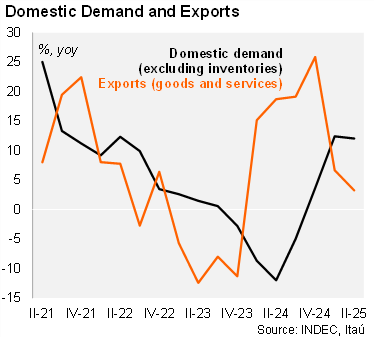

Final domestic demand – led by investment and private consumption – fell by 0.7% qoq/sa in 2Q25, from +3.4% in the previous quarter. Private consumption decreased by 1.1% in the quarter followed by a contraction in fixed investment of 0.5%. On the other hand, public consumption rose by 1.1% qoq/sa in 2Q25. On external demand, exports decreased by 2.2% qoq/sa, while imports fell by 3.3% qoq/sa in 2Q25. On an annual basis, domestic demand (excluding inventories) rose by 12.1% yoy, reflecting a 9.9% yoy increase in private consumption and a 32.1% gain in gross fixed investment. Moreover, public consumption rose by 0.6%. Regarding external demand, exports increased by 3.3% yoy, while imports rose by 38.3% yoy amid stronger ARS in real terms.

Our take: Given the weak performance of leading indicators for 3Q25 and the impact of high real interest rates on consumption amid political turmoil, we see significant downside risks to our GDP growth forecast of 5.0% for 2025. Manufacturing and construction both declined in July, and tax collection fell in real terms in August. According to Universidad Torcuato Di Tella's monthly index, consumer confidence decreased by 13.9% from July to August, due to deteriorating macroeconomic prospects and decreased willingness to purchase durable goods and real estate. Total loans decelerated significantly in the third quarter of 2025, increasing by just 0.1% in real terms in August compared to 1.9% in July and 3.6% in June amid higher nominal interest rates.