2025/09/18 | Diego Ciongo & Soledad Castagna

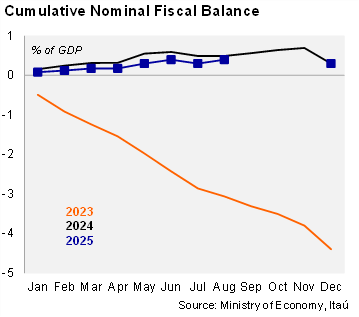

As expected, Argentina’s treasury ran another primary surplus in August of ARS 1,557 billion, above the surplus of ARS 900 billion posted one year earlier. The nominal fiscal balance posted a surplus of ARS 390.3 billion, above the ARS 3.5 billion surplus in August 2024. Consequently, the cumulative primary balance reached an estimated surplus of 1.3% of GDP during the first eight months of the year, while the cumulative nominal balance stood at 0.4% of GDP surplus. Thus, the fiscal framework remains as the main policy anchor of the government.

Real tax revenues increased in the quarter ended in August. Total real revenues expanded by 0.6% YoY in the quarter ended in August after decreasing 3.8% in 2Q25. Tax collection fell by 0.4% YoY in real terms in the period after falling by 3.1% in 2Q25.

Primary expenditures declined in the quarter ended in August. Primary expenditures fell by 2.3% YoY in real terms in the period, after falling 0.8% YoY in 2Q25 due to a base effect. Pension payments were up 10.5% YoY in real terms (+12.6% in 2Q25) amid the drop in inflation. Meanwhile, energy subsidies fell by 33.7% YoY, compared with a drop of 65.5% in 2Q25, while payrolls decreased by 8.3% YoY (-5.7% in 2Q25). Capital expenditure decreased by 31.8% YoY, after decreasing 27.6% in 2Q25. On the other hand, transfers to provinces increased by 20.6% YoY, which was affected due to base effects as they were frozen in the same period last year.

Our Take: Our primary budget surplus forecast for this year is 1.5% of GDP, which is in line with the official target recently presented in the 2026 Budget bill. The disciplined management of the fiscal accounts supports this forecast.